"Let Them Eat Fries"

by Joel Bowman

“If printing money would end poverty,

printing diplomas would end stupidity.”

~ Javier Milei

Buenos Aires, Argentina - "Where goes sound money, so too goes civil society. From drachma debasement in ancient Greece… to clipped coinage during the Roman Empire. From the freshly-inked assignats rolling off the presses in the lead up to the French Revolution… to the hollowing out of the Weimar Republic during the hyper-inflationary period of the 1920s… It seems that everywhere we look, monetary pride goes before societal decline… and fall. Whether denominated in Hungarian Pengos, Polish Zlotys, Brazilian Reals or Venezuelan Bolivars, experiments in monetary hijinks invariably end in tears.

From where we sit today, penning these words down here in Argentina’s capital… to the ruinous state of Zimbabwe, once known as “Africa’s breadbasket,” now little more than an economic basket case… Literally from A – Z, in countries the world over, history is replete with cautionary tales of what happens when the feds crank up the printing presses.

And yet, with that hoary old cry, “This time will be different!” our dear leaders urge us on, imploring we lowly citizens to ignore all past and documented experience to the contrary... and follow them into the monetary trenches.

Why do we fall for such an obvious ruse, over and over and again? Why do we suppose that the immutable laws of economics will be suspended, in our favor, just this once? Is it arrogance or ignorance that causes us to see ourselves as the precious exceptions to history’s iron-clad rule? Perhaps it’s a bit of both...

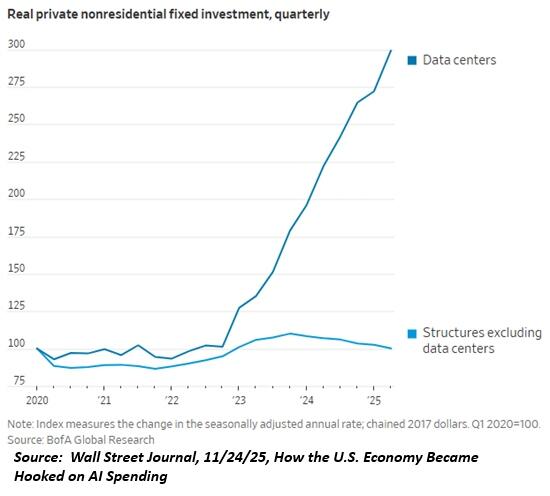

$4 French Fries: We found ourselves pondering price inflation yesterday, after a friend sent us a

Zerohedge article titled “The Uproar Over $4 Fries,” which included the following prices increases:

McDonald’s Price Increases from 2019 to 2024:

Medium French Fry $1.79 -> $4.19

McChicken $1.29 -> $3.89

Big Mac $3.99 -> $7.49

10 McNuggets $4.49 -> $7.58

Cheeseburger $1.00 -> $3.15

According to a consumer sentiment survey from the University of Michigan, cited in the article, “44% of middle-income respondents said their financial situation was worse than it was a year ago, while just 23% said it was better, based on a three-month average ending in September. Those who feel worse off overwhelmingly said it was because of higher prices.”

Hmm... 2019 to 2024. What happened during that inglorious period that might have caused such a run up in the prices of America’s favorite fast food?

Some commenters pointed to deals on apps, noting that “only bozos pay full price at the cashier.” Others blamed the rising cost of minimum wage labor for the increases. “When you’re paying $20/hour for the guy who mops the floor, it changes everything,” said one. “Restaurants are labor intensive and their workers are barely literate.” (Automation and minimum wages: a subject for another Note...)

Then there’s the multi-trillion-dollar shaped elephant in the room. Might, for example, these non-trivial line items have had anything to do with inflation hitting 40 year highs during the past half decade?

How about the CARES ACT of March, 2020 ($2.2 trillion), plus the Families First Coronavirus Response Act the very same month ($192 billion), and the Paycheck Protection Program & Health Care Enhancement Act a month later ($484 billion), the Consolidated Appropriations Act in December, 2020 ($2.3 trillion), the American Rescue Plan Act in March, 2021 ($1.9 trillion), the American Jobs Plan in March 2021 (est. $2 trillion), and the Opposites World-named Inflation Reduction Act ($500 billion)...

A coupla trill’ here… a coupla trill’ there… pretty soon, you’re starting to talk real money! (Or at least, real fake money…) Hmm… what might this potent profligacy portend for the empire’s future? Perhaps a look into the past can provide some clues…

Let Them Eat Fries: To take just one of the aforementioned examples, that of the French Revolution, the printing presses there were rolling long before royal heads were. Under Kings Louis XV and King Louis XVI, France had run up enormous debt loads, in part thanks to vast warfare expenditures abroad – including backing America in her own War of Independence – and lavish governmental expenses at home. Guns and butter, bread and circuses, welfare and warfare…the items on the shopping list change throughout the ages, but the net effect remains the same.

By the 1780s, France’s balance sheet was in tatters. The country’s General Assembly tried tax increases and spending cuts but such austerity measures proved, then as now, unpopular with the masses and so were soon abandoned in favor of less conspicuous methods. By the end of the decade, all honest options having been exhausted, the French did what so many mere mortals had done before: they looked around for a dishonest one. And they didn’t have to look far.

As the historian Andrew D. White recounted a century later in his rather unimaginatively titled book, “Fiat Money Inflation in France”..."Statesmanlike measures, careful watching and wise management would, doubtless, have ere long led to a return of confidence, a reappearance of money and a resumption of business; but these involved patience and self-denial, and, thus far in human history, these are the rarest products of political wisdom. Few nations have ever been able to exercise these virtues; and France was not then one of these few."

No doubt there were impassioned arguments on both sides, for and against money printing. Opponents pointed to historical disasters, such as the 1720 Mississippi Bubble, still relatively fresh in the Frenchmen’s collective memory.

Proponents, meanwhile, summoned that old saw, tried and true, against which so few politicians can hold their ground. “This time will be different,” they argued… same as always. And so it was that after long deliberation, the General Assembly agreed to a round of money printing… “juste cette fois,” (“just this once”) they’d have told themselves. The bills, assignats, were to be backed by Church property… especially confiscated for this very purpose. And so, like magic, 400 million of them were put into circulation.

And for a while, the old elixir seemed to do the trick. Commerce picked up, confidence rose and people got to work spending their newly inked notes. Oh, to be alive in the Summer of 1790, France! ‘twas surely the place to be! Then came the fall…

Devilish Deeds: By the time the leaves had turned from green to yellow, economic activity had begun to slump and, along with it, the hopes of the monetary conjurers and printing press prestidigitators. And then, sure as one season follows the next, “The old remedy immediately and naturally recurred to the minds of men,” as White observed. “Throughout the country began a cry for another issue of paper.”

Rather than admit they had erred – borrowing from the future that which the present had not yet earned – the General Assembly did what all such assemblies of men in their position do: they doubled down on their devilish deed. It was not the money-printing itself that was to blame, they rationalized, but rather the magnitude of issuance. 400 million units was simply not enough to stoke the embers and get the fire going again. Perhaps another round would help…

But by then, the fix was in. The conversation has shifted from “to print, or not to print?” to how much should be printed. And so, the presses were cranked up once again, and the newly-inked bills were sent forth across the land… 300, 400 and 600 million units at a time...

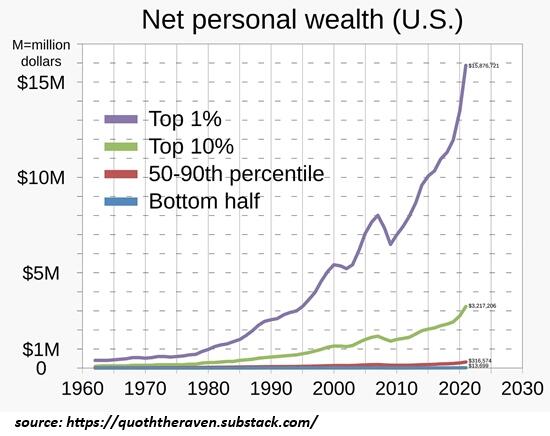

Here again Mr. White describes the scene: "The consequences of these over issues now began to be more painfully evident to the people at large. Articles of common consumption became enormously dear and prices were constantly rising. Orators in the Legislative Assembly, clubs, local meetings and elsewhere now endeavored to enlighten people by assigning every reason for this depreciation save the true one. They declaimed against the corruption of the ministry, the want of patriotism among the Moderates, the intrigues of the emigrant nobles, the hard-heartedness of the rich, the monopolizing spirit of the merchants, the perversity of the shopkeepers, - each and all of these as causes of the difficulty." And this was only the beginning. Where sound money had gone, civil society was about to follow…

False Prophets and Phony Profits: Slowly at first, then all of a sudden, peaceful protests turned violent, and angry mobs began smashing shopfronts and setting fire to businesses. A jilted peasantry thronged the cobblestones, demanding their daily bread, the price of which was cast adrift, afloat on an ever-rising tide of new fiat money. By the time King Louis XVI received the guillotine’s closest shave, in 1793, there were some 3.5 billion assignats in circulation. And when his wife, Marie Antoinette, lost her own head later that same year, the price of her infamous cake was far beyond the reach of most peasants.

And yet, fast-forward to the year 2025, and who should a population struggling under the crushing weight of trillions of freshly printed currency units – and the rising cost of living it necessarily manifests – turn to in order to relieve their age-old burden? Why, the false prophets of socialism, protectionism and big government collectivism, of course. The same rascals who delivered them their unjust deserts in the first place. Where goes sound money, indeed."

.jpg)