“The Individual vs. The Illusion Of Consensus Reality”

by Jon Rappoport

“This is such a supercharged subject, I could start from a dozen places. But let’s begin here: the individual is unique, because he is he. He is unique because he has his own ideas, because he has his own desires, because he has his own power. That power belongs to no one else. In particular, it doesn’t belong to the State. The State will try, will always try to suggest that it is granting power to the individual, but this is a lie. It’s an illusion broadcast with ill-intent. While everyone else is trying to manufacture connections to the group, under the banner of a false sense of community, the individual is going in the opposite direction.

Philip K Dick: “Insanity - to have to construct a picture of one’s life, by making inquiries of others.”

Consensus reality is the reality of sacrifice. It is coagulating energy, form, content, substance that takes on amorphous shapes studded with slots into which people can fit themselves.

The independent individual thinks what he wants to think. Over time, he keeps graduating into new, more nearly unique levels of what he wants to think. He rises above the group. He rises to his own thoughts.

There is no subject and no substance which is not infiltrated by consensus reality. Wherever you look, you will encounter it. The group is the basis of consensus reality, and the group pact extends everywhere. The group fears a sector where only individual thought can tread. That would be dangerous to the illusion. “Well, we’ve got things well in hand in most places, but over there and over here we’re not in charge. A different kind of reality pervades.” No, that doesn’t work for the group. The exceptions would blow a hole in the rule.

“Stay away from the corner of Lexington Avenue and 34th Street. Something too weird is going on there. We come in and try to inject consensus on that spot and it doesn’t work. Our “sharing” energy bounces off that corner. We may have to call in the troops to surround the place and cordon it off.” Alert! Alert! Consensus reality is breaking down in Sector 328-A! Locate the problem! This is an emergency! Bring in the news team to shore up the illusion! Turn on the hypnosis machines! Group consensus is fraying and fragmenting in Area 768-B! Call the professors and pundits! Discredit the individual! Call him a monster! Do something fast!

Consensus reality is an illusion in the sense that you can see it and I can see it, but we didn’t sign up for it. That’s the catch. Take any area of life, and I mean any, and that’s the case. Wherever there is tight consensus, perception ensues. That’s the whole point. “We, the group, aren’t fooling around. When we sign a pact among ourselves, we intend everybody to see what we decide is there to see.”

So you, the individual, can opt out. That doesn’t necessarily mean the consensus disappears; you can still see it, but you see it without accepting it. You can see the oasis in the desert, which is a mirage, but because you have your own bottle of water, you don’t have to run toward the mirage and fall down on your knees and try to drink from the pool.

Philip K. Dick: “Because today we live in a society in which spurious realities are manufactured by the media, by governments, by big corporations, by religious groups, political groups… increasingly, we are bombarded with pseudo-realities manufactured by very sophisticated electronic mechanisms… And this is an astounding power: that of creating whole universes, universes of the mind. I ought to know. I do the same thing.”

The strong and free individual evolves. He doesn’t stay the same. He doesn’t know everything worth knowing today. He knows enough, but not everything. He continues to emerge with new ideas, new energy, new invention. He becomes larger. He gains more power.

When the illusion of consensus reality attains a level beyond mere slogan, it enters the realm of systems. This is its most convincing format. A system appears to be watertight. Each one of its parts has relations with the whole. This is interesting, because that mirrors what a group is. Each member is a part that connects to the whole. Consensus as a system is like a game of chess that plays the same moves over and over. Game one is the same as game two, three, four… That’s where its illusion of power comes from.

The individual, though, doesn’t proceed according to systems. He isn’t moving from one closed context to another. That’s the group. The individual may retain the same general principles over time, but what he does and thinks strikes out into new territories. Because he creates. There is no individual without creating.

Consensus is the coin of the realm. It is forced from the top, and it is signed up for at the bottom. One hand washes the other. Societies may begin through consensus, but if they have any courage, they shift focus to the job of pulling away coercive restraints on the individual. Regardless, the individual asserts his freedom. It is his to begin with, not the group’s. No one gives it to him.

American society is moving rapidly to an inverse, an upside down structure, in which freedom is looked upon as a privilege grudgingly accorded in the absence of a reason to take it away. The prevalent official attitude is: consensus must be strengthened. It must dominate the landscape.

Through vast experience, the free individual knows that consensus has no theoretical limits. Group-perceptions about the way things are can give birth to the most universally “proven objective truths.” In his explorations, the individual may even find that a demonstrated law of nature is nothing more than a consensus. And, therefore, an illusion.

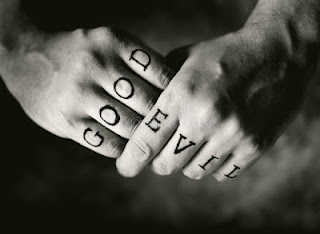

The group has conception of Normal. Normal is like a message passed around, from hand to hand, and when you look at it closely, for content, it dissolves. There was really nothing there. This is similar to what happens when physicists probe further and further into matter, looking for smaller and smaller particles, and come up with an enormous amount of empty space.

The group consensus is the illusion. Finally, there is mindless hive-action covering a vacuum. This is also what occasionally happens to people who have hidebound political ideologies. The people on the Left move further and further to the Left, and the people on the Right move further and further to the Right. Finally, they are both so distant from government they meet and stare at each other in shock. At that point, they are just individuals.

From my unfinished manuscript, "The Magician Awakes": “You keep saying it doesn’t matter. Sometimes you say it out loud and sometimes it’s just a very strong thought that could cut through a melon. You repeat it over and over - ”it doesn’t matter.” You’re sitting there with the most powerful thing in the universe, your imagination, and yet it doesn’t matter. New worlds are waiting for you. But you don’t pull the trigger.

“You go to meetings. What are these meetings? Who’s there? What do you talk about, the end of the world? Your problems? The conversations seem to be endless…”

“But society runs on groups! It must have groups!” And what? The individual must give in and join and belong? That’s the conclusion? I’m afraid not. Consensus reality is a cartoon that is trying to become as real as steel. What deconstructs the steel and exposes the cartoon? There is only one thing that can do that. Nothing and no one else is going to do that. The individual does it."