StatCounter

Saturday, February 27, 2021

Musical Interlude: Peder B. Helland, "Beautiful Piano Music 24/7 • Relax, Study, Sleep"

"Eviction Moratorium Ruled Unconstitutional, Largest Tsunami Of Evictions In U.S. History Incoming"

"Has The Great Shaking Of The Financial Markets Finally Begun?"

"A Look to the Heavens"

Chet Raymo, “All Men Have The Stars”

"Joy, Shipmates, Joy...”

"They Can Always Print More Money But We Can't Print More Time"

The Poet: Theodore Roethke, "The Far Field"

- Theodore Roethke

Musical Interlude: Jason Mraz, "I Won't Give Up"

"Upbeat Study Music - Deep Focus for Complex Tasks"

"Covid-19 Pandemic Updates 2/27/21"

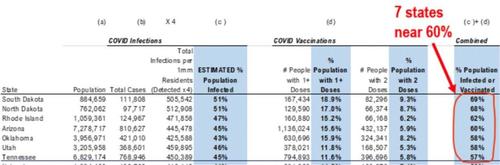

So far, South Dakota, North Dakota, Rhode Island, Arizona, Oklahoma, Utah, and Tennessee are the nearest.

Lee's "math" - which we also know is racist - appears to fit with Makary's arguments for why the recent plunge in cases, hospitalizations, and deaths is not policy-related (no matter how much the politicians and their media lackeys push that narrative): "...the consistent and rapid decline in daily cases since Jan. 8 can be explained only by natural immunity. Behavior didn’t suddenly improve over the holidays; Americans traveled more over Christmas than they had since March. Vaccines also don’t explain the steep decline in January. Vaccination rates were low and they take weeks to kick in."

"Experts should level with the public about the good news..." exclaims Makary, and this data on imminent herd immunity puts more pressure on Fauci and Biden to come clean... despite their variant-fearmongering and "no return to normal until Christmas or beyond" predictions.

Every day, our volunteers compile the latest numbers on tests, cases,

hospitalizations, and patient outcomes from every US state and territory.

- https://covidtracking.com/

○

"The Beatings Will Continue"

Friday, February 26, 2021

Musical Interlude: Deuter, "Black Velvet Flirt"

"A Look to the Heavens"

The Poet: Mary Oliver, “White Owl Flies Into and Out of the Field”

“Farewell to you and the youth I have spent with you.

It was but yesterday we met in a dream.

You have sung to me in my aloneness,

and I of your longings have built a tower in the sky.

But now our sleep has fled and our dream is over,

and it is no longer dawn.

The noontide is upon us and our half waking has turned to fuller day,

and we must part.

If in the twilight of memory we should meet once more,

we shall speak again together and you shall sing to me a deeper song.

And if our hands should meet in another dream

we shall build another tower in the sky.”

- Kahlil Gibran, “The Prophet”