"On to Moscow"

by Bill Bonner

Youghal, Ireland - "Let’s see, where are we? Who’s winning…who’s losing…so far? Gold investors are the big winners. The price of gold is $5,200/oz....up twenty times so far this century. The Dow is 48,000...up a little more than four times.) Oil investors got a boost last week. The price of crude shot up 36%, the sharpest spike in history.

Consumers breathed a sigh of relief when tariffs - the centerpiece of Trump’s economic policies - were struck down by the Supreme Court. They have not gone away, however. There is a mix of tariffs ranging from 10% to 50% still in effect, though some are likely to be challenged in court. And deficits are still going up. Fox: "Budget deficit hits $1 trillion in first five months of fiscal year."

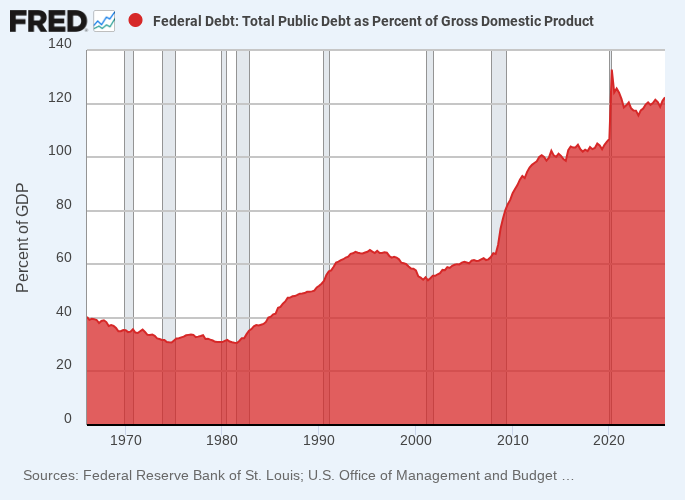

A guest at Barron’s Roundtable points out that Americans have a share of federal debt estimated at $250,000 per family. And it’s going up by about $15,000 per year. The national debt totaled about 58% of GDP in 1999. Now, it’s more than twice as much - 122% of GDP - thanks to a quartet of knuckleheads: Bush, Obama, Biden and Trump.

Republicans and Democrats seem to be competing to see who can make it worse by trying to buy votes with tax giveaways. Here are the Republicans hard at work. Newsweek: "Several tax policy changes introduced under President Donald Trump are expected to boost refunds for many households this year. Among the most significant updates are new rules eliminating taxes on certain types of income, including tips and overtime pay, alongside an expanded child tax credit. The Tax Foundation, an independent nonpartisan think tank, said refunds could range from between $300 and $1,000 for filers. So far, the average refund amount across all filers has grown by about $360 compared with the same stage last year, IRS data shows."

And here’s the proposal from the Democratic team. Newsweek, encore: "Senator Cory Booker has announced plans to introduce a bill that would significantly expand the standard tax deduction, effectively making the first $75,000 of income tax-free for married couples, with “proportional tax relief for single filers and heads of households,” according to an official statement from the New Jersey Democrats’ office."

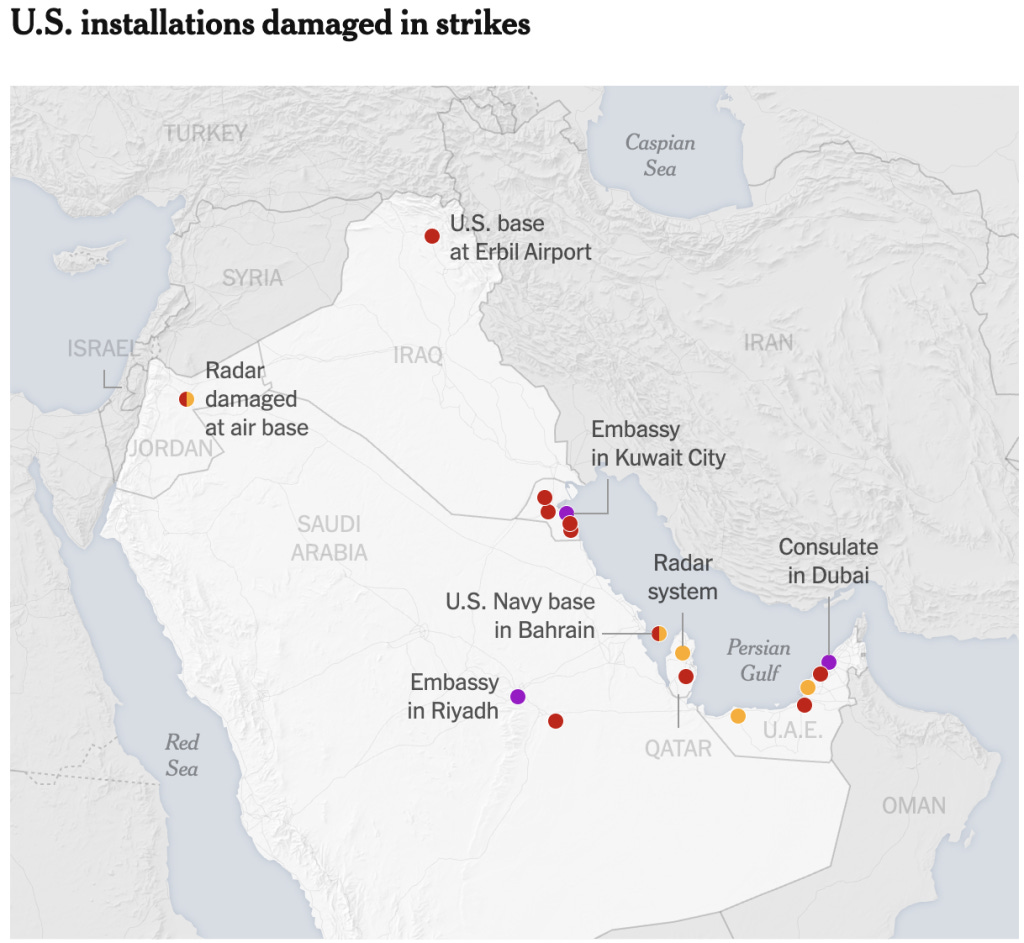

But the biggest dot we have to connect is the US attack on Iran, a war that it initiated for reasons that remain obscure. Who wins and who loses from that? This was first advertised as a ‘blitzkrieg’ that Trump said would be over in “two or three days.”

The US murdered Iran’s secular and religious leader in the opening hours of the fight - during Ramadan. Unfortunately, but hardly unpredictably, the masses didn’t begin waving US flags and opening trading accounts at BlackRock. Instead, the Pentagon is now saying the war could last until September.

If this were a war against Somalia or, say, Vietnam, it wouldn’t matter so much how long it went on. But this is a war against the country that might control the world’s most heavily trafficked oil pinch point - the Strait of Hormuz. Al Jazeera: "Iran’s Islamic Revolutionary Guard Corps (IRGC) says it will not allow “a litre of oil” through the Strait of Hormuz as the closure of the key Gulf waterway continues to roil global energy markets during the US-Israeli war on Iran." How effectively Iran controls the strait, we don’t know. But oil shippers don’t want to be the ones to find out. Trump’s offer to provide insurance coverage...or actually accompany the ships through the straits…seems to be beside the point. Either the Iranians can sink the ships - including the US Navy’s escorts - or it can’t.

In the meantime, the price of gasoline has gone back to Biden-era levels. CNBC: "Gas prices pass $3.50 per gallon to highest level since 2024 amid US-Iran war." Energy has gone from tailwind to hitting the economy squarely in the face. Gasoline is up 32% from 12 months ago.

Apparently, the only oil to get through the straits is bound for China...which allegedly is getting more oil than when the attack on Iran began. CNBC: "Iran sends millions of oil barrels to China through Strait of Hormuz even as war chokes the waterway. And so...in the ironic way History works...so far, China is the main beneficiary of America’s strikes on Iran. China gets oil...the rest of the world does not. And it - having harmed no one - is viewed as the safer, more reliable ally. Russia is a winner too; after working months to prevent it, the US is now allowing India to buy Russian oil. And the biggest loser? Iranians - including 168 children - suffered the Big Loss in the ‘first order effects.’

But the second order effects won’t be long coming. The administration claimed credit for a lower price of energy. If the war continues, and the price of oil stays high, it will probably be bad news for the Republicans in November’s mid-term elections. If it comes to that, it could be disastrous for POTUS, who – in his 80s -- could face more Epstein disclosures and some hard questions put to him by democrat-controlled committees. Either way, slow or fast, the march to Moscow will continue. Tune in tomorrow."