"Pulling Punches"

by Bill Bonner and Joel Bowman

Youghal, Ireland - "Yesterday, we opined that the Fed wouldn’t go ‘far enough’ in its fight against inflation. Today, we clue you in: the fight is rigged. The Fed will take a dive. Why? Because inflation is not a natural phenomenon. Instead, it’s federal policy. The feds wanted more money. Neither the taxpayers nor the credit markets were willing to provide it. The result was a policy – inflation. The Fed ‘printed’ up the necessary funds. It was spent. The real costs were pushed into the future. And this year, the future showed up.

Over the last 12 months, the interest on federal debt rose above $700 billion per year. As the Fed raises interest rates, the number will soon go over the cost of Social Security and Pentagon spending – combined. Meanwhile, inflation reached 40-year highs. What to do? There are only two choices. Inflate more. Or crash the economy and default on it.

Pressure Mounting: The Fed is headed towards default, with pressure to change course already mounting in the mainstream presses. The LA Times: "Painful signs emerge that Fed is moving too far, too fast with aggressive rate increases. The present danger...is not so much that current and planned moves will fail eventually to quell inflation. It is that they collectively go too far and drive the world economy into an unnecessarily harsh contraction."

And here’s MarketWatch: "‘Financial markets are throwing in the towel’: Recession fears escalate as Fed slams brakes on the economy. The likelihood of sharply higher interest rates has tilted the odds toward another recession within a year, economists say. Yet some still hold out hope the U.S. can muddle through with a period of slow growth instead of outright decline.

In a move widely expected by financial markets, the Federal Reserve orchestrated another jumbo-size hike in U.S. interest rates last week. What was unexpected was the central bank’s aggressive forecast for even higher rates in the year ahead. The surprise forecast triggered a major decline in the stock market as the realization sank in that the Fed is determined to squelch the highest U.S. inflation in 40 years - no matter the cost."

Throw in the towel? When stocks are only just tipping into bear market territory? There will be plenty of towels to throw in later. In the meantime, we’ve got a long way to go. Then, the Fed will ‘pivot’ like a ballerina. The media will celebrate the great man; another ‘Tall Paul’ Volcker, they will say. The markets will soar on the good news. But that is not for now. Not yet. That will require an emergency; Jay Powell has not caused one… yet.

A Most Remarkable Period: In this farce, our hero – Jerome Powell – must suffer… he must overcome great challenges… he must persevere against evil and overwhelming odds. Only then, he can announce his great victory over inflation… and go back to inflating the economy.

In the most remarkable period in US financial history, America’s government debt went from just $23 trillion in 2020 to nearly $31 trillion today. That additional $8 trillion of spending should have stimulated the pants off of the economy. Instead, it was squandered on wars and stimmies… and now is recalled – like a wine-stained bill from a fancy bordello – only as debt. The Fed partied hard. We measured it yesterday as about $50 trillion in asset prices above ‘normal’ and $47 trillion in excess debt (above the traditional 180% of GDP level).

An alert Dear Reader comments: "$50 trillion in surplus wealth. $47 trillion in surplus debt. That those two numbers are almost equal can’t be a coincidence. What they obviously imply: Over the past 4 decades, there’s been little REAL wealth creation in the US. It’s almost all just debt." Now, getting back to normal means erasing both of them.

The Fed’s Fake Coin: And here lies the dramatic tension at the heart of our tale. The Fed cannot launder out the stains of debt without also washing away the credit. The two are linked together – asset and liability – both sides of the Fed’s fake coin.

The Fed flooded the economy with $8 trillion in fake money, and trillions more in fake credit offered at fake interest rates. All of this ‘money’ created fake wealth… in stocks, bonds, and real estate. But it also created excess debt of almost the same amount. Now, the owners of that wealth – not by coincidence either! – just happen to be the same people who decide on federal policies. They may be desperate to rid themselves of the debt – but not the wealth. Fake or not, they like it.

Can they ditch the debt and keep the wealth? How will that work out? It is not very promising. As the Fed raises rates, asset prices come down. A house might have sold for $400,000 to a person with a 3% mortgage. Now, with mortgage rates approaching 7%, how much is it worth? $300,000? $200,000?

As the collateral comes down, so does the value of the money lent against it. Existing debt – bonds, notes, mortgage debt… even US government debt – all go down in value. Who’s going to want a 2020-vintage 10-year US T-bond bearing a 1% coupon… when he can buy a new one earning 4%? Who’s going to lend to Wall Street when he can get 3% in an FDIC-protected savings account? We don’t know. But we’re sure there’s an empty congressional seat waiting for him somewhere.

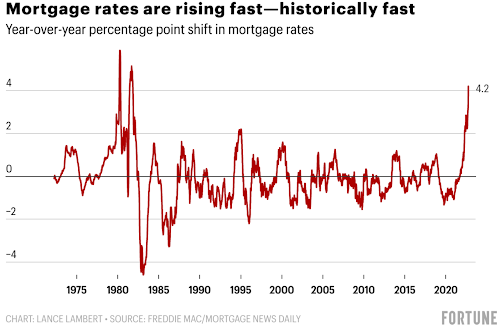

Joel’s Note: Speaking of home loans, the national average for a 30-year mortgage just topped 7% for the first time since 2000. Moreover, it was also the fastest 1% increase in history, taking place in less than one month. (It only topped 6% two weeks ago…) What does this mean for the average American “home loaner?” And what does it portend for that great ballast of American, middle class family wealth?

According to data compiled by the Atlanta Fed, the median American family now needs to spend more than half their income to service payments on the median-priced American home. That’s the highest percentage level in over 15 years and almost double what it was just 12 months ago. If that looks like the biggest mortgage rate shock in over 40 years… that’s because it is. (H/T to @NewsLambert at FortuneMagazine for this worrying chart)…

Meanwhile, yesterday’s Case-Shiller Home Price Index showed an “unexpected” (by “experts”) drop in home prices month-over-month. The 20-City Composite index fell 0.44% on the month, far below the expected 0.20% increase. It was the first sequential drop in home prices tracked by Case-Shiller in more than a decade.

It makes one wonder how people can afford to get by, what with rising rates, falling home prices, 40yr high inflation and plummeting stock markets…In completely unrelated news, total credit card debt is up more than 20% over the past year. Hmm…"