"A Huge Mistake"

Baltimore, Maryland - "Having despaired at trying to figure out what Mr. Trump is...we look at what he is not in order to see what is not coming. We’ve tried several labels for Donald Trump. The only one that seemed to stick was ‘capitalist,’ but of an antique variety...relatively rare in today’s world.

A real, modern capitalist uses savings to provide a product or a service that is worth more than the labor and materials (the capital) that went into it. Thus, he ends up with more capital...and the world is a richer place. Win…win.

This is the process that Adam Smith described in the "Wealth of Nations." The capitalist seeks to make money for himself, but he does so by making things better for others. This is also at the heart of modern - New Testament era - morality in which we are taught to ‘do unto others as we would have them do unto us.’ We want others to give us soup and shelter; we need to figure out what we can give in exchange. That is the only ‘equality’ that societies can actually provide — an equal and smiling respect for the ‘golden rule’ that benefits everyone.

Industrial economies, beginning in the 19th century, made these free exchanges possible on a vast scale. And in the rough and tumble of turn-of-the-century (1900) industry...people, in the aggregate, prospered. The Titans of industry, however, became fabulously wealthy. Those titans - Ford, Rockefeller, Vanderbilt, et al - got rich by providing lots of autos, fuel, transportation and so forth.

Then, along came John Maynard Keynes. In his "Treatise on Money 1930", he made the startling claim that money was not an innocent bystander. Eerily prescient, but staggeringly off base, he claimed that rich people preferred to hoard their wealth in the financial economy, rather than spend it or invest it in the industrial economy, leading to depression and unemployment.

Saving has always been suspect. Scrooge saved his money. Jesus tells of a master, who berated his servant, for saving his money rather than investing it. And King Midas, turning everything into gold, starved to death.

This ancient prejudice helped to justify the 1971 sleight of hand that switched real money with ‘paper’ money. The post-1971 dollar solves Keynes’ problem. There is no ‘liquidity preference’ for this new money. Just the opposite. There’s an illiquidity preference, a desire to get rid of it before it loses value.

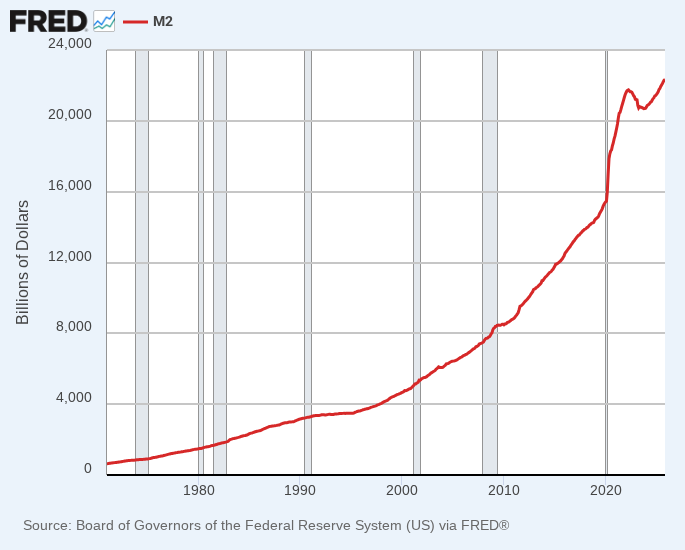

Broad US Money Supply (M2) since 1971.

The old money was ‘slow’ money. It took time to earn it...forbearance to save it...care and study to invest it...and often decades for it to pay off. But this new money was ‘fast’ money. It could be created in seconds...and then used in a speculation that might pay off in hours...days...or weeks. Its titans were from Wall Street, not Detroit or Gary, Indiana. They did not necessarily add to the world’s wealth. Part of the ‘bubble economy,’ not the industrial economy, they were money manipulators...leveraged speculators…and the Donald J. Trumps. Even Warren Buffett, who invests in the ‘industrial’ economy, owes much of his fortune to the bubble money that drove up prices for the last 43 years.

The available money supply is a combination of the quantity of it, along with the speed by which it changes hands. That was Keynes’s complaint against gold; people tended to hold it too long, he said. Not so this new money. The faster it changes hands, the faster each unit goes down in value.

Up until now, the ‘debasement’ of the dollar - the loss of value caused by increases in the available money supply - has been shared with much of the world. Other countries use the dollar as a reserve currency, saving it (and thus off-setting the worst effects of over-supply.)

As Putin observes, the ‘huge mistake’ of Team Trump was to upset this happy hustle by using the paper dollar, not only to cover its excess spending, but also to force other nations to do its bidding. The US must now enforce its ‘exorbitant privilege’ - the ability to ‘print’ money and export the inevitable inflation - with kidnappings, murder and war.

Have you connected the dots, dear reader? Not many leaders would have made the ‘huge mistake.’ Even fewer would be willing to go to war to try to head off its consequences. But Donald Trump is a creature of this new post-1971 dollar system. And now he is its number one protector. So, what is it that he absolutely, positively cannot do? "Stay tuned.

Perfect example of Trump Derangemrnt Syndrome

ReplyDelete