StatCounter

Wednesday, November 26, 2025

"Connecting The Dots Reveals A Dire Future" (Excerpt)

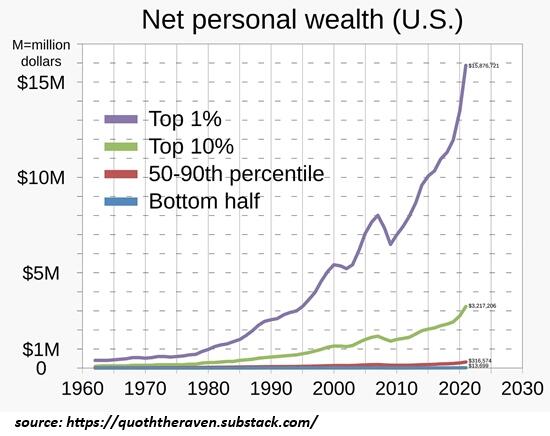

"The Middle Class Is Cracking"

I've been addressing these issues for many years. Here are a few of my posts on the decay of the middle class:

• Priced Out of the Middle Class (June 28, 2012)

• What Does It Take To Be Middle Class? (December 5, 2013)

• Misplaced Pride: Most of the "Middle Class" Is Actually Working Class (June 14, 2019)

3. Income/expenses that enable the household to save at least 6% of its net income.

4. Significant retirement funds: 401Ks, IRAs, etc.

6. Reliable vehicles for each wage earner.

9. Ability to invest in offspring (education, extracurricular clubs/training, etc.).

10. Leisure time devoted to the maintenance of physical/spiritual/mental fitness.

"When Is It Going To Happen? The Truth Is That It Is Happening Now"

Tuesday, November 25, 2025

"They're Not Governments, They're Mental Institutions, And The Inmates Are Running The Asylum"

"The Consumer Is In Big Trouble - Everyone Is Losing Their Job And Has No Money Saved"

"Retirement Has Become A Financial Nightmare And Everyone Is Starting To Panic"

"A Look to the Heavens"

The Poet: William Stafford, “Starting With Little Things”

"A Revision Of Belief..."

"A Mess..."

"What Happens When We Die"

Even if we understand that dying is the token of our existential luckiness, even if we understand that we are borrowed stardust, bound to be returned to the universe that made it - a universe itself slouching toward nothingness as its stars are slowly burning out their energy to leave a cold austere darkness of pure spacetime - this understanding blurs into an anxious disembodied abstraction as the body slouches toward dissolution. Animated by electrical impulses and temporal interactions of matter, our finite minds simply cannot grasp a timeless and infinite inanimacy - a void beyond being.

But then, when that day loomed near as he grew old and infirm, “the poet of the body and the poet of the soul” suddenly could not fathom the total disbanding of his atomic selfhood, suddenly came to “laugh at what you call dissolution.” And then he did dissolve, leaving us his immortal verses, verses penned when his particles sang with the electric cohesion of youth and of health, verses that traced with their fleshy finger the faint contour of an elemental truth: “What invigorates life invigorates death.”

Toward the end of the novel, Mr g watches, with heartache unknown in the Void predating the existence of universes and of life, an old woman on her deathbed, the film of her long and painful and beautiful life unspooling from the reel of memory, leaving her grief-stricken by its terminus, shuddering with defiant disbelief that this is all. “How can a creature of substance and mass fathom a thing without substance or mass?” wonders Mr g as he sorrows watching her succumb to the very laws he created. “How can a creature who will certainly die have an understanding of things that will exist forever?”

And then, as a faint smile washes across her face, she does die. Lightman writes: "At that moment, there were 3,147,740,103,497,276,498,750,208,327 atoms in her body. Of her total mass, 63.7 percent was oxygen, 21.0 percent carbon, 10.1 percent hydrogen, 2.6 percent nitrogen, 1.4 percent calcium, 1.1 percent phosphorous, plus a smattering of the ninety-odd other chemical elements created in stars.

And the individual atoms, cycled through her body and then cycled through wind and water and soil, cycled through generations and generations of living creatures and minds, will repeat and connect and make a whole out of parts. Although without memory, they make a memory. Although impermanent, they make a permanence. Although scattered, they make a totality."

"Do Not Let Your Fire Go Out..."

"You Must Be..."

"How do you know I'm mad?" said Alice.

"You must be," said the cat, "Or you wouldn't have come here."

- Lewis Carroll,

"The Hidden Agenda: How Governments Use Inflation To Redistribute Wealth"

1. In a fiat currency system, the government inevitably prints ever-increasing amounts of currency to fund itself.

2. This makes prices and living costs rise faster than wages.

3. The average person feels the pain but doesn’t understand why.

4. More people support politicians who promise freebies to ease the pain.

5. To pay for those "freebies," the government prints even more currency.

6. The result? More inflation - and the cycle repeats.

.jpg)