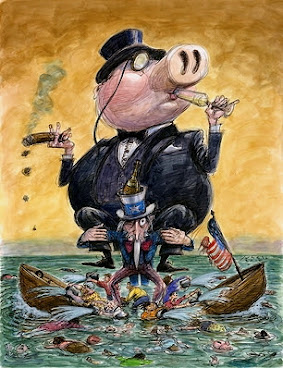

"Middle Class Blues"

Plus, sinking real estate, Marx vs. Lachmann,

dividing the elites and plenty more...

by Bill Bonner and Joel Bowman

San Martin, Argentina - "Uh oh. More bad news for the middle class. Fortune: "National home prices fall for the seventh straight month. On Tuesday, we learned that U.S. home prices as measured by the seasonally adjusted Case-Shiller National Home Price Index fell for the seventh straight month in January. Since peaking in June, U.S. home prices have fallen 3% on a seasonally adjusted basis, and 5% without seasonal adjustment. That 3% drop in single-family house prices marks the second-biggest home price correction of the post–World War II era."

And this from the Wall Street Journal: "Most Americans Doubt Their Children Will Be Better Off, WSJ-NORC Poll Finds."An overwhelming share of Americans aren’t confident their children’s lives will be better than their own, according to a new Wall Street Journal-NORC Poll that shows growing skepticism about the value of a college degree and record-low levels of overall happiness."

Today and tomorrow, we look at it from a different angle…and see why it is likely to get whacked even harder.

“Don’t Fight the Fed” Karl Marx believed the driving force of social/political/economic history was the struggle between the classes. Richard Lachmann believed it was the struggle within various elite groups. Lachmann is probably more right than Marx. The masses pay taxes. They vote for their leaders. They die in wars. But they are not the deciders. Even revolutions are usually led by disenchanted members of the elite, not by the common man.

Lachmann is probably right, too, when he says the actual course of events is an accident…the product of competition between elite factions, along with unpredictable technological and social developments.

Not interested in macro, socio-historical blah-blah? We aren’t either. But ‘don’t fight the Fed’ has been good advice for the last 40 years. Will it be good advice for the next 40? The Fed controls monetary policy. And the federal government controls fiscal policy. Between the two of them, they decide the future of the US dollar…and the US economy. Naturally, we want to know what they’re up to.

Remember, is not by guessing, one day to the next, about stock prices, that you really make money on Wall Street. Instead, it is by being in the right place at the right time…and staying there as the Primary Trend runs its course. Recall, too, that the Primary Trend reversed itself – after 4 decades – in two turnarounds. The bond market hit a record high in July 2020. The last time it had done that was around the time we were born – in 1948. Since 2020, it has been going down.

And the stock market topped out at the end of 2021. The Dow rose over 36,000. It has been dropping ever since…with tempting bounces along the way. (One of the endearing features of a bear market is that it tries to take as many investors as possible down with it. Over the 40 years, 1982-2922, investors learned to BTFD [buy the dip]; now, every bounce leads them back into dip-buying…and then the market dips again.)

But back to Lachmann…Divide the Conquerors. In short, he may be on to something. And it may help us understand what is coming next. The elite have approximately $50 trillion in new wealth, thanks to the policy choices of their compadres at the Fed and the federal government over the last 30 years. Congress spent money it did not have. And the Fed financed the deficits at ultra-low interest rates. Those low rates were responsible for an orgy of borrowing and spending that 1) raised corporate profits and asset prices, 2) provided vast funds for elite projects (such as stock buybacks…the invasion of Iraq…the Covid Lockdown…), and 3) led to today’s $90 trillion debt burden.

Historically, the US could comfortably carry debt equal to 1.5 times GDP. That is, for every dollar of output (GDP) we could afford $1.50 worth of claims against it (debt). But the Fed’s way-too-low, for way-too-long interest rate policy distorted the old relationships. Had normal interest rates produced normal debt levels, we’d have total debt today of about $40 trillion. Instead, we have $90 trillion…or $50 trillion too much.

Who will decide what happens to the excess? Not the voters! The deciders will decide. And there are only two broad possibilities. Deflation or inflation. Either the excesses are reckoned with in the traditional, honest way – with bankruptcies, defaults, and market crashes. Or, they are inflated away.

Clearly, the elite prefer inflation, because much of the ultimate cost will fall on the public, not on themselves. But here is where it gets interesting. Lachmann tells us that when the elite is divided, it often cannot get what it wants. Republicans vs. Democrats…conservatives vs. liberals…left vs. right – are the internal divisions so deep that the elite cannot stick together… and stick it to the common man? Tune in tomorrow for more…"

Joel’s Note: "While residential real estate prices continue their downturn, analysts have their noses to the screens monitoring the looming crisis in the $20 trillion commercial real estate market. Here’s the Washington Post: "The initial banking crisis is easing. Another may be around the corner. Commercial real estate could become a problem for midsize banks. Federal authorities still grappling with the banking crisis caused by the collapse of Silicon Valley Bank are already beginning to worry about the next potential bomb to go off in the nation’s financial system.

In the White House, Treasury Department and Federal Reserve, policymakers are examining the potential risks posed by the approximately $20 trillion market for commercial real estate, which some analysts project is heading for a crash over the next two years, according to four people familiar with the matter, who spoke on the condition of anonymity to reflect private conversations."

Bonner Private Research readers will be familiar with this theme… one we’ve covered on and off for the past few months. Here’s Bill, musing just last week…"The banking sector that saw the most growth over the past 10 years was commercial real estate. In the Bubble Epoch, it paid to borrow money at very low interest rates – from banks – in order to buy commercial buildings.

But then, what happened? At first, prices rose nicely and speculators made money. Cometh the Covid Hysteria, however, the bets went bad. Buildings emptied out. And still, 3 years after Trump’s emergency decree, they’re far from back to normal. Our employees in Baltimore, for example, have learned to work from home. They don’t want to come back to the office. And as a result, we have buildings that are half empty…and some that are completely empty.

And BPR investment director, Tom Dyson, from his January report to members…"The entire commercial real estate industry operates at massive leverage. What do owners do when an asset appreciates in value? They borrow more money against it, as the owners of this building must have done. Then, because owners always seek to maximize leverage, any significant fall in property values ensures huge swathes of the industry turns into negative equity.

An article in the San Francisco Chronicle this week reports that San Francisco’s largest landlord, Veritas, has just defaulted on a $448m loan. The loan is secured by a portfolio of 1,734 rent-controlled units in 62 buildings across San Francisco." Here’s another story, from Globe St, published yesterday. A company called Chetrit Group from New York is looking to sell a portfolio of 43 buildings in order to pay off a floating rate $481m loan that it can no longer afford.

Are these stories just random misfortunes or are they the tip of an iceberg that hasn’t been revealed yet? I’m inclined to think it’s an iceberg, but we’ll have to wait and see... In San Francisco, office vacancy rates hit 30% for the first quarter of 2023. Back east, meanwhile, brokerage firm Savills calculates that close to 19% of all high-end office space in Manhattan was available for lease in the fourth quarter of 2022, up from just 11.5% in early 2019.

The pandemic sent the kids home to work… now they don’t want to come back. The situation is such that, earlier this week, the world’s sometimes-richest man, Elon Musk called the state of the commercial real estate debt market ‘by far the most serious looming issue.’ Translation: Iceberg ahead!"