StatCounter

Saturday, May 25, 2024

Bill Bonner, "Wicked Words"

"Happily Men Don't Realize..."

and the more you realize you don’t know.”

- Bill Bonner

“The Immutable Laws of Nature, and Murphy’s Other 15 Laws”

"How It Really Is"

Dan, I Allegedly, "Real Trouble for Real Estate"

"Ireland, Spain And Norway Recognize Palestinian State"

"Alert! Military And Government Officials Secretly Preparing, Eites Make Nuclear Exit Plans!"

Friday, May 24, 2024

Judge Napolitano, "INTEL Round Table: Johnson & McGovern - Weekly Wrap Up"

"McDonald's Is Hazardous To Your Health; New Cars Piling Up At Dealers, No Buyers"

"A Look to the Heavens, With Chet Raymo"

Gerald Celente, "Genocide Joe Stealing Our Dough And Keeping The War Going"

"10 Items That Will Become Impossible To Find At Costco Stores"

Before you realize it, you’re hooked on this new product – maybe even changing up your daily routine around it – only to discover that on your next shopping trip, it’s nowhere to be found. Now, you have to try to find a substitute that won't be nearly as good, or even worse, buy it at big-box stores for regular retail prices.

That's what's happening to many consumers in 2024. Even though the warehouse club is known for cycling products in and out at astonishing rates, – always keeping unexpecting members on their toes, – this year, it seems that the company is discontinuing multiple items without any notice, giving superfans no chance to stock up on their new obsessions before it stops selling these items at its locations.

Last winter saw its fair share of product layoffs in the grocery department and, apparently, spring cleaning time has begun at Costco. So far, the chain has discontinued over 30 items across the aisles, including household essentials and pantry desserts.

Today, we compiled some of the products shoppers are now mourning at the wholesale store, and we are going to explain why there’s even more bad news coming for Costco fans. So stay tuned until the end of the video."

The Poet: Paul Laurence Dunbar, “We Wear The Mask”

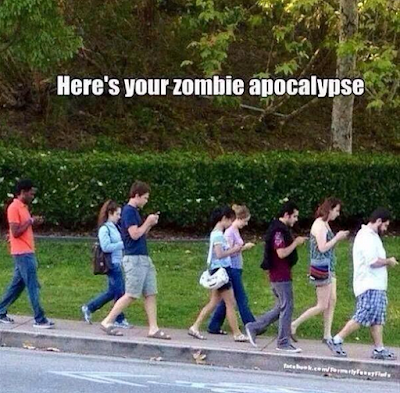

"Mental Laziness Is More Common Than Ever: How to Overcome It"

Dan, I Allegedly, "Shrinkflation Scandal Revealed! $6 Filet-O-Fish"

"The Truth, Neutrinos, Taylor Swift, And Otto Von Bismarck"

"The Continual Rise in the Cost of Living… And Why the Fed has No Shame"

"Jay Powell did it again assuring the 1% that he has their back. Markets recovered their poise over the last 24 hours, as investors were relieved after Fed Chair Powell stuck to his recent views on the economic outlook. In his remarks yesterday, he said that recent data didn’t "materially change the overall picture" and that on inflation "it is too soon to say whether the recent readings represent more than just a bump." In addition, he reiterated that if "the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year." So that all helped to validate market pricing, which still expects 71 bps of rate cuts from the Fed by the December meeting.

In the case of savers, retirees, wage-earners in globally impacted industries where wages haven’t kept up with the CPI, isn’t the above enough punishment? Doesn’t it actually amount to state-directed expropriation of their living standards and modest accumulated wealth? In any event, what the hell is so almighty urgent about rate cuts when the economy is still growing apace and the cumulative inflation of the last seven years has not been relieved in the slightest?

Increase In Major Cost-of-Living Components of the CPI Since January 2017

At the same time, it is highly unlikely that a return to low rates will do much for the moribund growth rates in the industrial economy, as represented here by real-value added in the nondurable goods industries. Long ago, much of US production of shoes, shirts, sheets, household supplies and the like was off-shored to lower cost venues abroad. And locking in the current inflated domestic costs levels plus another 2-3% per year going forward will not bring them back. In sum, the Fed’s fiddling with interest rates is largely irrelevant to the supply-side path of the two industries shown below, and countless more just like them.

Inflation-Adjusted Federal Funds Rate, 2001 to 2024