"Fool Us Once"

A message for some of the people, some of the time...

by Joel Bowman

Buenos Aires, Argentina - “There's an old saying in Tennessee - I know it's in Texas, probably in Tennessee - that says, fool me once, shame on - shame on you. Fool me - you can't get fooled again.” - George W. Bush

“What if they’re wrong?” It was a question that came up a few times this week in Bill’s missives... and one that should always be on our mind. What if they’re wrong about the economy... about inflation... about climate... about masks and vaccines and two weeks to flatten the curve? What if they’re wrong about “the Fauci Effect”... about the $433 billion Inflation Reduction Act... about $80 billion in “aid” to the Ukraine?

Mind you, there’s nothing political here. Or at least, there shouldn’t be. Rather, the fact that merely asking the question - any question - has become politicized at all... is in itself a cause for concern.

Take the Covid, for example. Time was, regular, non-partisan citizens would want to know about the origins of a virus that spurred governments into shutting down the entire global economy... and pressing the “reset” button. “If we knew whence it came, perhaps we’d be able to better understand it,” Joe Citizen might reason. “Perhaps we’d be able to develop a whole range of treatments to help fight it. And maybe, just maybe, we could take measures to prevent such a thing from happening again.”

Seems... rational. But in the wake of the outbreak... and the subsequent lockdowns that were imposed, on the old and the young, the sick and the healthy, the at-risk and the carefree... to say nothing of the vaccine mandates, where people’s careers were destroyed, their reputations sullied, their families torn apart, all for standing up for nothing short of bodily autonomy...to so much as ask the question was tantamount to treason, to being against “The Science,” as if there were such a thing, set in stone and impervious to skepticism. (When of course, the exact opposite is true – science, as a process, nourishes itself on the prying curiosity of the skeptical mind.)

“A Devastating Take Down”: And yet, people who dared wonder aloud, to stick their neck out publicly, were cast as heretics, unbelievers, declared public enemies. Concerning the highly questionable efficacy of mass lockdowns, the director of the NIH, Francis Collins, exchanged emails with Tony “The Science” Fauci, in which he called for a “quick and devastating take down” of any dissenting discussion of the matter... including from leading experts in the field. You can read his actual email for yourself, thanks to a Freedom of Information Act filed by the American Institute for Economic Research, right here...

(Source: AIER)

Those “fringe epidemiologists” to whom Collins referred were professors Martin Kulldorff, Sunetra Gupta and Jay Bhattacharya... hailing from such off-the-wall conspiracy tanks as Harvard, Oxford and Stanford Universities, respectively. The crackpot trio of dangerous skeptics dared favor a policy they termed “focused protection,” in which high-risk populations, such as the elderly or those with medical conditions, were given extra care and the young and healthy were left to carry on with things like... oh, keeping the world economy from collapsing and tens of millions of people falling into poverty as a result. Thousands of scientists signed the declaration—provided, of course, they were able to learn about it.

Again, there shouldn’t be anything political about this... either lockdowns work, or they do not. A good-faith, open, objective examination of the evidence ought to help decide the case. Alas, when the situation calls for a scalpel, the administrative state arrives with a chainsaw, hacking away like a possessed maniac.

Of course, one can hardly blame them for behaving the way they do. You wouldn’t get mad with a crocodile for eating your pet chihuahua. (But you might not let Fluffy too close to the shore...) In the end, the feds have nothing but weapons of mass disruption... and a reflexive instinct to use them. There’s no finesse. No nuance. No gray area. So it goes in matters of monetary policy, too; there’s on... or off. Raise... or cut. Inflate... or die. It’s just the nature of the beast.

As to the question at hand, “What if they’re wrong?”, the market seems to believe that inflation is “whipped,” that the Fed can relax its rate hiking frenzy and that, therefore, the worst of the selling is over, with nothing but blue skies ahead.

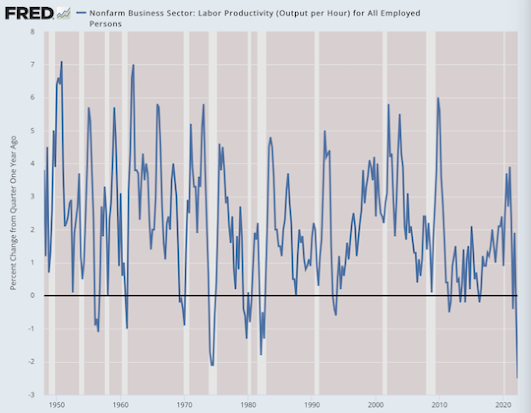

Bonner Private Research’s Investment Director, Tom Dyson, is quite not so convinced. He dared question the prevailing narrative in a research note sent to members this past Wednesday. Here, Tom outlines the Big Picture as he sees it..."The long era of low inflation in the West is over. This era was fueled by cheap Chinese goods, cheap energy and cheap immigrant labor. It was temporary. And it’s finished.

We’ve now entered a new era of high but capricious inflation. This is the single most important long term economic fundamental you need to understand. It changes everything, and will determine the big trends in the markets for decades to come. Maybe even for the rest of our lives. Call it a generational regime change. Most people are completely unprepared for this. They continue to operate under the old regime. It’s going to be a long and painful adjustment for them.

High but capricious inflation means higher interest rates… everywhere. Why? Because the Feds have been fighting deflation with asset price inflation for 40 years. Now they’re going to be doing the opposite: fighting inflation with asset price deflation. It’s the reverse. They’re going to need persistently higher interest rates to do this. Talk of an imminent Fed pivot is nonsense. The Fed is going to keep raising interest rates and reducing the size of its balance sheet. Other central banks will follow the Fed’s lead.

Negative yielding debt will never be seen again. In fact, the entire central banker playbook will change. The old playbook said “always be easing.” The new playbook says “must fight inflation and must uphold central bank credibility.” No more quantitative easing. No more easy money backstop. No more “buy-the-dip.” Now inflation is here, these tools are redundant. Recessions will become more frequent. Like in the old days. It was normal to have two recessions per decade.

Stock market valuations will be lower, generally. Also like the old days. The last 40 years were an aberration. That high plateau of valuations is giving way to more normal valuations. If interest rates move permanently higher, then stock valuations must move permanently lower. Because of this, I think the S&P 500 is in the early stages of a long bear market."

.jpeg)