Sunday, March 12, 2023

Saturday, March 11, 2023

Musical Interlude: Liquid Mind, "My Orchid Spirit (Extragalactic)"

Liquid Mind, "My Orchid Spirit (Extragalactic)"

Full screen highly recommended.

○

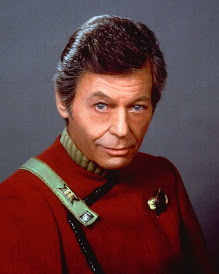

"In this galaxy, there's a mathematical probability of 3 billion Earth-type planets. And in all of the universe, 2 trillion galaxies like this. And in all of that... and perhaps more, only one of each of us."

- "Dr. Leonard McCoy"

"A Look to the Heavens"

Will the spider ever catch the fly? Not if both are large emission nebulas toward the constellation of the Charioteer (Auriga). The spider-shaped gas cloud on the left is actually an emission nebula labelled IC 417, while the smaller fly-shaped cloud on the right is dubbed NGC 1931 and is both an emission nebula and a reflection nebula.

About 10,000 light-years distant, both nebulas harbor young, open star clusters. For scale, the more compact NGC 1931 (Fly) is about 10 light-years across.”

○

" I do not question the presence of intelligent life on other planets;

but I do question its existence on this one."

- Dr. Ivan Desantis

"2nd Biggest Bank Failure In U.S. History: On The Verge Of A Much Bigger Collapse Than 2008"

Full screen recommended.

"2nd Biggest Bank Failure In U.S. History:

On The Verge Of A Much Bigger Collapse Than 2008"

By Epic Economist

"The wait for the next “Lehman Brothers moment” is over. On Friday, we witnessed the second biggest bank failure in U.S. history. The stunning collapse of Silicon Valley Bank is shaking the financial world to the core. As of the end of last year, the bank had $175 billion dollars in deposits, and approximately $151 billion dollars of those deposits were uninsured. In other words, a lot of wealthy individuals and large companies are in danger of being wiped out. In particular, this is being described as an “extinction level event” for tech startups, because thousands of them did their banking with SVB. I cannot even begin to describe how cataclysmic this is going to be for the tech industry as a whole.

The closure marks the biggest bank failure since the 2008 financial crisis and the second-largest in U.S. history after Washington Mutual collapsed during that industry-wide meltdown, according to FDIC data.

Worries over a run at SVB led Wall Street investors to dump other bank stocks as well. Shares of some prominent West Coast lenders took sharp nosedives Friday, including First Republic Bank, PacWest Bancorp and Western Alliance Bancorporation.

Once the dominoes start falling, it will be difficult to stop the process. In fact, the situation is already so dire that Peter Schiff is proclaiming that we are “on the verge of a much bigger collapse than 2008”…“Banks own long-term paper at extremely low interest rates. They can’t compete with short-term Treasuries. Mass withdrawals from depositors seeking higher yields will result in a wave of bank failures.” Of course a lot of the “experts” in the mainstream media never saw this coming.

Unfortunately, SVB’s situation is not unique. Thanks to rapidly rising interest rates, many other banks are also sitting on mountains of Treasury bills that have lost a lot of value…As I have been telling my viewers, our system simply cannot handle higher rates at this point. But the “experts” at the Fed assured all of us that they knew exactly what they were doing. Now they have caused one of the biggest bank failures in U.S. history, and much worse is on the way if they do not reverse course.

But I don’t expect the “experts” at the Fed to listen to any of us. They are just going to keep doing what they are doing, and we are all going to have to live with the consequences."

Comments here:

"This Is the Start of the Bank Crash"

Full screen recommended.

Dan, iAllegedly PM 3/11/23:

"This Is the Start of the Bank Crash"

"Silicon Valley Bank is going to dramatically affect multiple industries. You will see companies file bankruptcy within the week. There are hundreds of companies that have zero chance of getting their money out of the bank."

Comments here:

"Jim Cramer Told You To Buy Silicon Valley Bank - Big Mistake; Stay Calm, Your Money Is Gone"

Jeremiah Babe, 3/11/23:

"Jim Cramer Told You To Buy Silicon Valley Bank -

Big Mistake; Stay Calm, Your Money Is Gone"

Comments here:

The Poet: Robert Service, "Prelude"

And shared the rugged lot

Of fellows rude and unrefined,

Frustrated and forgot;

And now alas! it is too late

My sorry ways to mend,

So sadly I accept my fate,

A Roughneck to the end.

Profanity is in my voice

And slag is in my rhyme,

For I have mucked with men who curse

And grovel in the grime;

My fingers were not formed, I fear,

To frame a pretty pen,

So please forgive me if I veer

From Virtue now and then.

For I would be the living voice,

Though raucous is its tone,

Of men who rarely may rejoice,

Yet barely ever moan:

The rovers of the raw-ribbed lands,

The lads of lowly worth,

The scallywags with scaley hands

Who weld the ends of earth."

- Robert Service

"In The End..."

"What we think, or what we know, or what we believe is, in the end,

of little consequence. The only consequence is what we do."

- John Ruskin

"The Housing Crash is Looming"

Full screen recommended.

Dan, iAllegedly 3/11/23:

"The Housing Crash is Looming"

"The numbers are in and we are seeing that the housing market is taking another hit. Interest rates are absolutely destroying new purchases and people are canceling contracts that record rates."

Comments here:

The Poet: Neil Gaiman, "What You Need To Be Warm "

"What You Need To Be Warm

"

"A baked potato of a winters night to wrap

your hands around or burn your mouth.

A blanket knitted by your mother's cunning fingers.

Or your grandmother's.

A smile, a touch, trust, as you walk in from the snow

or return to it, the tips of your ears pricked pink and frozen.

The tink tink tink of iron radiators waking in an old house.

To surface from dreams in a bed,

burrowed beneath blankets and comforters,

the change of state from cold to warm is all that matters, and you think

just one more minute snuggled here before you face the chill. Just one.

Places we slept as children: they warm us in the memory.

We travel to an inside from the outside.

To the orange flames of the fireplace

or the wood burning in the stove.

Breath-ice on the inside of windows,

to be scratched off with a fingernail, melted with a whole hand.

Frost on the ground that stays in the shadows, waiting for us.

Wear a scarf. Wear a coat. Wear a sweater.

Wear socks. Wear thick gloves.

An infant as she sleeps between us. A tumble of dogs,

a kindle of cats and kittens.

Come inside. You're safe now.

A kettle boiling at the stove. Your family or friends are there.

They smile.

Cocoa or chocolate, tea or coffee,

soup or toddy, what you know you need.

A heat exchange, they give it to you, you take the mug

and start to thaw.

While outside, for some of us, the journey began

as we walked away from our grandparentshouses

away from the places we knew as children:

changes of state and state and state,

to stumble across a stony desert, or to brave the deep waters,

while food and friends, home, a bed, even a blanket become just memories.

Sometimes it only takes a stranger, in a dark place,

to hold out a badly-knitted scarf, to offer a kind word,

to say we have the right to be here,

to make us warm in the coldest season.

You have the right to be here.

"

- Neil Gaiman

Neil Gaiman reads

"What You Need To Be Warm"

here:

The Poet: Czeslaw Milosz, “A Song On The End Of The World”

“A Song On The End Of The World”

“On the day the world ends

A bee circles a clover,

A fisherman mends a glimmering net.

Happy porpoises jump in the sea,

By the rainspout young sparrows are playing

And the snake is gold-skinned as it should always be.

On the day the world ends

Women walk through the fields under their umbrellas,

A drunkard grows sleepy at the edge of a lawn,

Vegetable peddlers shout in the street

And a yellow-sailed boat comes nearer the island,

The voice of a violin lasts in the air

And leads into a starry night.

And those who expected lightning and thunder

Are disappointed.

And those who expected signs and archangels’ trumps

Do not believe it is happening now.

As long as the sun and the moon are above,

As long as the bumblebee visits a rose,

As long as rosy infants are born

No one believes it is happening now.

Only a white-haired old man, who would be a prophet

Yet is not a prophet, for he’s much too busy,

Repeats while he binds his tomatoes:

There will be no other end of the world,

There will be no other end of the world.”

~ Czeslaw Milosz

"Bank Run USA Panic – Second USA Bank Collapses in 3 Days, Run of Withdrawals Causes Liquidity Crisis"

"Bank Run USA Panic – Second USA Bank Collapses

in 3 Days, Run of Withdrawals Causes Liquidity Crisis"

By IWB

(Reuters) – "U.S. lenders First Republic Bank (FRC.N) and Western Alliance (WAL.N) said on Friday their liquidity and deposits remained strong, aiming to calm investors worried of a spill-over of risks from troubled startup focused-bank SVB Financial Group (SIVB.O). Shares of the three banks slumped between 20% and 60% in choppy trading that led to halts and resumptions. The disclosures come after banking regulators shut California-based SVB after a failed share sale that triggered worries of a liquidity crisis, hammered bank stocks and rippled through global markets.

o

Greg Hunter, "$2.5 Quadrillion Disaster Waiting to Happen"

"$2.5 Quadrillion Disaster Waiting to Happen –

Egon von Greyerz"

By Greg Hunter’s USAWatchdog.com

"There is sufficiency in the world

for Man's need but not for his greed."

- Mahatma Gandhi

"Egon von Greyerz (EvG) stores gold for clients at the biggest private gold vault in the world buried deep in the Swiss Alps. EvG is a financial and precious metals expert. EvG is a former Swiss banker and an expert in risk. He says the risk in the global markets has never been this high.

EvG explains, “Credit has increased dramatically through derivatives. All instruments being issued now by banks, pension funds, stock funds, it’s all synthetic. There is no real underlying payments in anything almost. Therefore, my estimate for derivatives would be at least $2 quadrillion, and I think that is probably conservative. Then, we have debt on top of that of $300 trillion, and we also have a couple hundred trillion dollars of unfunded liabilities. So, we are talking about $2.5 quadrillion, and that’s with a global GDP of $80 trillion. So, there is a disaster waiting to happen, and especially because all this created money has created no value whatsoever. I always knew this would collapse, and it’s taken longer than I expected, but I think we are at the end of a major era.

These derivatives, at some point in the coming few years, will actually turn into debt. Central banks will have to cover all the outstanding liabilities of the commercial banks as we are seeing now with Credit Suisse, Bank of England and etc. This is going to happen across the board. Whether it’s called derivatives or called debt, as far as I am concerned, it’s the same thing. It will have the same effect on the world financial system, which will be disastrous, of course.”

EvG says the derivative markets were simply a way for financial institutions to carry debt and not show it on their balance sheets. In the end, everything will balance out. EvG goes on to say, “Nobody can repay the debt, and they can’t even pay interest. So, therefore, when the debt implodes, so will the assets that were financed by this debt. So, both sides of the balance sheet have to come down. Whether it comes down by 50%, 75% or 90%, I don’t know. All I think about is risk, and the financial system will not survive in its present form. Central banks only use one kind of medicine, and that is more printed money. Now, you are getting negative returns on printed money. So, that is not going to save anything.

Sadly we are looking at a situation when this system will start to implode. The rich are still rich, but the poor are really poor. Overall in the UK, Germany and most European countries, people don’t have enough money to live. This is a human disaster already. With food costs going up 25% and energy going up the same and gasoline, interest rates and rents, people don’t have enough money, and that is happening now. It’s a human disaster of mega proportions. It’s so sad, and governments will have no chance of doing anything about it.”

In closing, EvG says, “This is why it is getting closer for implosion because the whole system can’t take this. The risk is increasing exponentially. So, I think people should be prepared. Most asset markets have lost money, and it is going to get worse.” There is much more in the 43-minute interview.

Join Greg Hunter on Rumble as he goes One-on-One with Egon von Greyerz of Matterhorn Asset Management, which can be found on GoldSwitzerland.com.

o

Related:

“Parasitic Derivatives: $1.5 – 2.4 Quadrillion Dollars, Too Big to Understand”

“Parasitic Derivatives: $1.5 – 2.4 Quadrillion Dollars,

Too Big to Understand”

By David Hague

“I recently returned from two weeks of ‘high level’ meetings with a group of Bankers [this is code for two weeks of subsidized debauchery with bankers] in Rome. As I sat at my desk, I was hoping to motivate myself to pursue a more chaste and pure existence. Unfortunately the Polar Vortex experienced by North America drained me of my good intentions. The bone chilling cold once again had me reaching for my trusty bottle of Jack Daniels for warmth and inspiration. My time in Rome had not been completely ‘wasted’, so to speak. I had secured a contract from the European Central Bank [ECB] to research the topic of Derivatives. I was to present my findings at the upcoming World Economic Forum in Davos later that month.

One Quadrillion Dollars: Too Big to Understand: Dear Reader, please resist your natural instinct to click away from this commentary at the mere mention of the word ‘Derivatives’. I am acutely aware of the boredom and befuddlement that this word instills in you. At this point I would simply remind you that the derivatives market is estimated to exceed one quadrillion dollars. [This incredibly large number is actually an accurate estimate of the size of the derivatives marketplace]. (In addition, unfunded liabilities, like medical care and pensions, are at least $300 trillion globally. If we add gross derivatives of $1.5 quadrillion, which are likely to turn into real debt as counterparties fail, the total debt and liabilities are above $2 quadrillion. Source - CP) Despite the fact the derivatives market eclipses the market capitalization of the NYSE by an exponential factor, it is not discussed, reported or tracked because it is simply too complicated and opaque. Warren Buffet’s, comment about ‘weapons of mass financial destruction’ seem to be the beginning and end of any discussion on the topic.

Derivatives are a parasitic financial instrument: For those of you who are unschooled on the topic of derivatives, allow me to explain. Derivatives are abstract financial instruments, which, like parasites, can attach themselves to all manner of stocks, bonds, mortgages, commodity, debt obligations, currency exchange, interest rate fluctuations… in short, anything. Derivatives exist in the ‘twilight zone’ of the banking industry. Like black holes, their presence and massive influence are acknowledged yet the true influence on the global economy of this quadrillion dollar ‘event horizon’ is only theoretical. The near catastrophic disasters at Barings, JP Morgan and AIG are small examples of their destructive powers. However I will offer you Investorpedia’s more clinical definition. “A security whose price is dependent upon or derived from one or more underlying assets. The derivative itself is merely a contract between two or more parties.”

You got to know when to hold ‘em, know when to fold ‘em, {Kenny Rogers}: One might think of derivatives as a random game of online poker: you don’t know who your opponents are [your counterparty], you do not know if you will be paid [counterparty risk], you do not know if the game is legitimate, [lack of regulation], and your opponents are probably able to see what cards you are holding, [market domination by large banks]. As well, you are making bets that in many instances neither you nor your opponents fully grasp [complexity of the market]. With each wager you are potentially risking not only your current assets, but your future assets as well. [Leverage]. In some cases you do not know how much you are betting. Imagine as well, that you play this game every day with trillions of dollars that you do not have. This is the global derivatives market.

It is all Greek to me: Alternately, as derivatives are often created as a form of insurance, think of them as an insurance policy in which you:

• Do not know the name, address or any contact information relating to your insurer.

• Do not know if your insurer has the resources to pay a claim.

• Do not understand the insurance contract as it is written in Greek.

• Must rely on a shadowy third party [ISDA] to decide what constitutes a claim. [Credit event]

• Do not know whether your insurer is itself vulnerable to the particular risk you have contracted with it to insure.

His moral lassitude allowed him to excel: Dear Reader, I digress, let me return to my narrative. The aforementioned lucrative contract was secured by two key factors. The first factor was my friendship with Gustavo Laframboise-Pierre, the European Central Bank’s [ECB] Global Director of Statistical Creation. My relationship with such an esteemed member of the ECB traced its roots back to Gustavo’s days as a bookie for Wall Street’s elite. I referred so much business to him we became very good friends. His station in life took a remarkable turn when a senior member of the ECB, while in New York on a ‘fact finding mission’ [this is code for visiting his favorite escort] made an outrageously large and incorrect wager on the outcome of the 2010 World Cup. (Perhaps unsurprisingly, the term ‘derivative’ is commonly used in sports betting!) The only way the debt could be settled was for the banker to offer Gustavo a highly paid sinecure at the ECB. Gustavo became the Global Director of Statistical Creation with the responsibility of making up statistics to support whatever fantastical and deranged policies Central Banks around the world were initiating. Remarkably Gustavo’s aptitude for numbers, coupled with his moral lassitude allowed him to excel at his job. It was Gustavo who invented the term ‘Quantitative Easing’ as a benign euphemism for runaway money printing.

Where ignorance is bliss, ‘tis folly to be wise’: The second factor that secured the contract for me was a chance remark I made as Gustavo and I enjoyed a ‘working lunch’, with several senior executives who represented many of the world’s largest banks. The working lunch was held at Rome’s exclusive Blue Moon Gentleman’s Club. As the featured dancer left the stage I happened to mention to the assorted luminaries that I had read an article on the subject of derivatives. The bankers looked at me with something akin to awe and reverence. Gustavo whispered to me that the topic of derivatives had been discussed in a recent conference call by the world’s bankers. The conclusion reached at that time was that derivatives were too boring and too complicated for bankers to grasp. Despite JP Morgan’s very public, expensive and monumentally stupid 5 billon dollar derivatives trading loss bankers still choose to remain cocooned in a ‘Cloak of Ignorance’ as it relates to derivatives. Thomas Gray’s lament that ‘where ignorance is bliss, ’tis folly to be wise’ could easily be the mission statement of the global banking industry.

I had read a complete article, I was a ‘de facto expert’: Dear reader, I am not being rude and offensive in my remarks about JP Morgan. Surely you would agree with me that any large bank that loses $5 billion in derivatives trading is ignorant of the properties and risks of derivatives? The fact that I had actually read a complete article on the subject made me a de facto expert on the topic. Gustavo, in an act of kindness, seized the opportunity on my behalf and pressed his colleagues to retain me to research the topic and make a presentation at the upcoming World Economic Forum in Davos. Thus I found myself preparing to dazzle the world’s financial elite with my insights into the risks and opportunities presented by the global derivatives market. In a rush to complete the deal before the next dancer took the stage it was agreed that I would receive the standard banker’s honorarium of $5,000/hour up to a maximum of ‘whatever it takes’.

At $5,000/hr., you would surely not expect me to be brief: I sat at my desk, sipping ‘Gentleman Jack‘ while I looked out at the bleak weather that made Brooklyn so depressing in the winter. My TV was tuned to CNBC, as I waited for Wall Street to open. I put my crack pipe in its case. Dear reader like many of you [especially those of you who work in the banking industry], I have learned all too well, the dangers of mixing crack cocaine with whiskey on an empty stomach. [Have we not all indulged, to our regret, that particular venial sin at least once?] I collected my thoughts and began to write my lengthy tome on the derivatives market. Dear reader at $5,000/hr., you would surely not expect me to be brief.

Lions and Tigers and Bears [and derivatives] Oh My!: I do not want to frighten you. However I will share with you some facts about derivatives that will have you reacting as nervously as Dorothy did in the Wizard of OZ when confronted with the thought of Lions and Tigers and Bears. ‘Derivatives, Oh My’, will I suspect be the words that escape your lips.

• Size of the derivatives market: 1.5 – 2.4 QUADRILLION dollars

• Size of Global Stock and bond markets: 175 trillion dollars

• Who regulates the Derivatives market? LOL, Regulation is a ‘work in progress’ dominated by the big banks.

How dangerous are derivatives? They almost destroyed the world’s largest insurance company, AIG, as well as the global economy. Seriously, you don’t remember? Just Google the words AIG and collapse. Alternately you might call Jamie Dimon at JP Morgan and ask him if Derivatives are dangerous. Have recent regulatory changes made the world economy less likely to implode from a derivative fuelled explosion? Actually as one might expect, thanks to regulatory enhancements that had to run the gauntlet of bank lobbyists prior to their approval, the world’s economy is in more danger than ever from a derivatives inspired meltdown.

‘Duck Dynasty’ and ‘Real Housewives’ to the rescue: How much attention does the Main Street pay to the world’s largest and riskiest casino? [AKA: the Derivatives market]. If one were to Google the word derivatives, one will get 34 million ‘hits’. Alternately, if one does a similar search for the words stocks bonds and markets one will get 400 million ‘hits’. The 34 million ‘hits’ generated by a Google search of the word derivatives compares unfavorably with the 37 million ‘hits’ generated by a search of the term ‘Real Housewives of Atlanta’, the 209 million ‘hits’ generated by a search of the term ‘Duck Dynasty’ or the 713 million ‘hits’ generated by searching the word ‘Sex’. One must conclude that only when derivatives are discussed by one of the ‘Real Housewives of Atlanta’ posing nude in bed with one of the cast members of ‘Duck Dynasty’ will derivatives receive the attention they deserve.

Reality bites: Derivatives can only be discussed as ‘Fake News’: Where can one find insights and coverage of the Derivatives Market in the mainstream media? Is Fox News or CNN my best choice? Sadly Dear reader your best choice would have been The Daily Show with Jon Stewart. Despite the calamitous risk and obvious importance of this topic only Mr. Stewart and his team dared to share information with the general public. Given the outlandish and frightening risks derivatives constitute to the Global Economy, perhaps Mr. Stewart was correct that it can only be discussed in the ‘Fake News’ format.

Derivatives: better suited for Ripley’s Believe it or not than the Wall Street Journal: How bizarre is the derivatives market? How is the concept of money for nothing propagated by the derivatives market? What is the difference between a chump and a champion in the derivatives market? I will leave it to Shah Gilani in his excellent post in “Wall Street: Insights and Indictments“ to explain. Suffice to say that one is able to buy insurance in the derivatives market. One can then cause the insured event to occur by collaborating with a third party. All that remains is to collect the insurance proceeds. [To be clear the proceeds are usually in the tens of millions of dollars.] The derivatives market makes the Ponzi-like money printing of the Central banks look like ‘Amateur Hour’.

Who needs ‘Crack’? Dear reader, usually I needed a little help from my friend Mr. Crack to feel as paranoid and euphoric as I did at this moment. Paranoid, because it was clear to me that the derivatives market was truly a weapon of mass financial destruction. Euphoric because I knew that my research would make my ‘Derivatives’ presentation at the World Economic Forum a groundbreaking ‘tour de force’ that would vault me to the forefront of ‘talking heads’ that pass for experts on mainstream media. Fame, fortune, a book deal and perhaps that elusive Nobel Prize would surely follow. My twenty minutes of painstaking research, had made me one of the world’s foremost experts on this complex subject. [BTW Dear Reader by reaching this point in my commentary, you surely now know more about derivatives than most bankers and traders on Wall Street. You should be quite pleased.]

David, you are an imbecile: I decided to reach out to my pal Gustavo and share some of my findings. I knew that it was 3:30 in the afternoon in Paris so I would be able to catch Gustavo just as he arrived for another day of work. “Gustavo”, I intoned, breathless with excitement. “I have uncovered some startling, controversial, and frightening information about derivatives. The luminaries and leading lights who attend my presentation in Davos will be utterly gobsmacked by my revelations. The media will undoubtedly ensure that my findings go viral. The topic of derivatives will no longer exist only in the dark shadows of the banking industry. The danger that derivatives pose to the global economy will permeate the consciousness of Main Street.” Gustavo sighed, “David, I do not know if you are stupid or naïve. Every September when you bet $1,000 that the perennially atrocious Toronto Maple Leafs will win the Stanley Cup, I assumed you were simply ingenuous. Your comments today have convinced me that you are an imbecile. Let me assure you that those will not be the findings that you present at the World Economic Forum. Rather you will inform the world that derivatives are a financial instrument that is being used by brilliant and prudent financial professionals to mitigate risk and make the world a safer place.”

The ‘Truth Will Out’: “Gustavo”, I groaned, “that would be a lie. I cannot in good conscience, sacrifice my integrity, my honor, my core beliefs and my good name simply to placate Wall Street and the Central Banks. I have a responsibility to my readers on Main Street to inform them, to warn them, to prepare them for the likely financial chaos that derivatives will cause”. “Gustavo”, I said with iron willed determination, “the Truth Will Out”. “David”, Gustavo snarled, “If you change the tenor of your presentation and indicate that derivatives are the most benign form of financial instrument, somewhat akin to Treasury bills, we will double your fee”.

Move along nothing to see here: Dear Reader, in summary let me say that derivatives are the most benign form of financial instrument, somewhat akin to treasury bills. Gustavo’s immutable logic and persuasive argument was instrumental in helping me reach the correct conclusion regarding the risks to the Global economy posed by derivatives. So Dear Reader, move along, there is nothing to see here.”

"Biggest Bank Failure In U.S. History – 'We Found Our Enron' – 'On The Verge Of A Much Bigger Collapse Than 2008'” (Excerpt)

"Biggest Bank Failure In U.S. History – 'We Found Our Enron' –

'On The Verge Of A Much Bigger Collapse Than 2008'”

by Michael Snyder

Excerpt: "The wait for the next “Lehman Brothers moment” is over. On Friday, we witnessed the second biggest bank failure in U.S. history. The stunning collapse of Silicon Valley Bank is shaking the financial world to the core. As of the end of last year, the bank had 175 billion dollars in deposits, and approximately 151 billion dollars of those deposits were uninsured. In other words, a lot of wealthy individuals and large companies are in danger of being wiped out. In particular, this is being described as an “extinction level event” for tech startups, because thousands of them did their banking with SVB. I cannot even begin to describe how cataclysmic this is going to be for the tech industry as a whole. There is so much to cover, and so let me try to take this one step at a time."

Full article is here:

o

Musical Interlude: Il Divo, "Wicked Game (Melanconia)"

Full screen recommended.

Il Divo, "Wicked Game (Melanconia)"

(Live In London 2011)

"The Good Demagogue"

"The Good Demagogue"

by Addison Wiggin

“War is the health of the state.”

– Randolph Bourne

“I was in the Soviet Union in the 90s,” Rickards tells me in his interview this week. “Three big black SUVs pulled up in front of my hotel in Moscow and the first car and the second car had all four doors open. All these thugs and dark suits with machine guns under their coats created a security perimeter,” he enthralls. “They opened the SUV door and two little 10-year-old girls in party dresses got out. They were going to a birthday party, but they were the daughters of an oligarch.”

That’s the absurdity of it all. Young kids are made to live under the gun. Maybe the names and the deeds have changed. But the narrative has not. Who actually wants to fight a war? Who wants to send their sons and daughters into danger? Do the theories of the West coveting Russian land… or Ukrainian wheat… or shipping lanes into Sevastopol warrant death?

The unfortunate lesson of history is that war is the natural outcome of a failure of politicians to guard the people from fighting words and things they don’t understand or care about. “China and the US have locked themselves into a new cycle of recriminations,” Bloomberg Surveillance writes, “provoking fresh worries that the world’s two biggest economies are heading down a path that could one day lead to the once unthinkable: the possibility of open conflict.”

A palpable and mounting distrust for “the other side” recalls images of a Red Scare or McCarthyism. Paranoia from within. “Even worse, the escalating rhetoric is entrenching divisions that could make it harder for both sides to find a way to co-exist peacefully over the long term,” Bloomberg concludes. Why don’t we listen to these words?

Our viewers on Youtube had trouble swallowing some of the things Jim had to say about the War in Ukraine. “I follow Jim for his financial advice,” commented the oddly named Zummbot, “but I must say I was taken aback by his terrible and ill-informed take on Ukraine.” He (it?) continues in dismay:

"It’s ironic these two talk of propaganda (of which there is undoubtedly plenty on both sides) when just repeating verbatim the Russian propaganda line. In truth, the Ukraine war is the deal of the century for the US. We get to exhaust the military capacity of one of our chief rivals on the world stage for a relative pittance and do none of the dying. The Chinese-Russian partnership is born of weakness, not strength."

“If only it were that simple,” Bill Bonner might chuckle in response. That is the problem with this kind of “Bad Guy Theory”; it is dangerous nonsense that only appeals to simpletons. People are neither always good, nor always bad… but always subject to influence.

No doubt, the imagery from Ukraine has been manipulated from the onset. “Remember during the early days of the war,” Rickards says. “There'd be a Ukrainian patriot in battle fatigues with an M4 rifle, and there were just these absolutely gorgeous women defending the Ukraine. And you look at them and say, ‘Wow, she could be a model.’ Turns out they were models. They were actually Vogue models posing as soldiers.”

“They're really good at PR and propaganda,” Rickards explains with fervor. “They're being killed by the hundreds of thousands. The country's being destroyed.”

This, we believe, is the truth of it. Whatever propaganda channel is reaching our eyeballs is inevitably tinged with the tentacles of political assumption; under all of it, under all the rubble and rabble, a country and a people decimated by powers greater than they. A proving ground for the symptoms of an emotional polity, easy to manipulate, easy for “thesis-creep” (Ken Griffin of Citadel talks about this too, with regard to financial politics at home) an easy climate of rage to be capitalized upon by a good deceitful demagogue.

So it goes,"

"The Fed Will Overshoot & Kill the Economy"

"In today’s episode, I have with me back on the show Jim Rickards. Jim is an American lawyer, economist, and investment banker. He's the best-selling author of a number of books on currencies, gold, the global economy, and most recently sold out an analysis of supply side inflation and why the Fed is powerless to do anything about it."

Comments here:

"Something Like Reverence...:

“When the pain of leaving behind what we know outweighs the pain of embracing it, or when the power we face is overwhelming and neither flight nor fight will save us, there may be salvation in sitting still. And if salvation is impossible, then at least before perishing we may gain a clearer vision of where we are. By sitting still I do not mean the paralysis of dread, like that of a rabbit frozen beneath the dive of a hawk. I mean something like reverence, a respectful waiting, a deep attentiveness to forces much greater than our own.”

- Scott Russell Sanders

God help us, God help us all...

Friday, March 10, 2023

"Watch For Bank Failure Contagion As Systemic Meltdown Worsens"

Gregory Mannarino, PM 3/10/23:

"Watch For Bank Failure Contagion As

Systemic Meltdown Worsens"

Comments here:

"Breaking: Widespread Bank Panic; Emergency Nuke Message Sent to Millions; Countries Prep for Worst"

Full screen recommended.

Canadian Prepper, 3/10/23:

"Breaking: Widespread Bank Panic;

Emergency Nuke Message Sent to Millions; Countries Prep for Worst"

Comments here:

Subscribe to:

Posts (Atom)