Saturday, April 16, 2022

Must Watch! "Should I Buy A House Now? Shocked - Bank Account Robbed; No Food Means Big Problems"

Jeremiah Babe, 4/16/22:

"Should I Buy A House Now? Shocked - Bank Account Robbed;

No Food Means Big Problems"

Musical Interlude: 2002, “Where The Stars And Moon Play”

Full screen recommended.

2002, “Where The Stars And Moon Play”

“Pamela and Randy Copus are the duo known as 2002. Randy Copus plays piano, electric cello, guitar, bass and keyboards. Pamela Copus plays flutes, harp, keyboards and a wind instrument called a WX5. Both musicians also provide all of the vocals on their albums, recording their voices many, many times and layering them to create a "virtual choir" with a celestial, angelic quality.”

Chet Raymo, “The Journey”

“The Journey”

by Chet Raymo

“Here’s a deep-deep sky map of the universe from the March 9, 2006 issue of Nature. The horizontal scale is a 360 view right around the sky; the vertical gaps at 6 hours and 24 hours are the parts of the universe that are blocked to our view by the disk of our own Milky Way Galaxy. The vertical scale – distance from Earth – is logarithmic (10, 100, 1000, etc.) measured in megaparsecs (a parsec equals 3.26 light-years). Across the top is the Big Bang, and the oldest and most distant thing we can see, the cosmic microwave background, the radiation of the Big Bang itself. A few relatively nearby galaxies are designated at the bottom. All that stuff in the middle that looks like smoke or dusty cobwebs are quasars and galaxies from the Sloan Digital Sky Survey.

A smoke of galaxies! (2 trillion galaxies according to latest estimates.- CP) A universe cobwebbed with Milky Ways! Each galaxy itself a smoke of stars, hundreds of billions of stars, many or all of them with planets. My book, “Walking Zero,” is about the human journey from the omphalos of our birth into the world of the galaxies, a journey many of us are disinclined to make. Here is how the Prologue to the book begins:

“Each of us is born at the center of the world. For nine months our physical selves are assembled molecule by molecule, cell by cell, in the dark covert of our mother’s womb. A single fertilized egg cell splits into two. Then four. Eight. Sixteen. Thirty-two. Ultimately, 50 trillion cells or so. At first, our future self is a mere blob of protoplasm. But slowly, ever so slowly, the blob begins to differentiate under the direction of genes. A symmetry axis develops. A head, a tail, a spine. At this point, the embryo might be that of a human, or a chicken, or a marmoset. Limbs form. Digits, with tiny translucent nails. Eyes, with papery lids. Ears pressed like flowers against the head. Clearly now a human. A nose, nostrils. Downy hair. Genitals.

As the physical self develops, so too a mental self takes shape, not yet conscious, not yet self-aware, knitted together as webs of neurons in the brain, encapsulating in some respects the evolutionary experience of our species. Instincts impressed by the genes. The instinct to suck, for example. Already, in the womb, the fetus presses its tiny fist against its mouth in anticipation of the moment when the mouth will be offered the mother’s breast. The child will not have to be taught to suck. Other inborn behaviors will express themselves later. Laughing. Crying. Striking out in anger. Loving.

What, if anything, goes on in the mind of the developing fetus we may never know. But this much seems certain: To the extent that the emerging self has any awareness of its surroundings, its world is coterminous with itself. We are not born with knowledge of the antipodes, the plains of Mars, or the far-flung realm of the galaxies. We are not born with knowledge of Precambrian seas, the supercontinent of Pangea, or the Age of Dinosaurs. We are born into a world scarcely older than ourselves and scarcely larger than ourselves. And we are at its center.

A human life is a journey into the grandeur of a universe that may contain more galaxies than there are cells in the human body, a universe in which the whole of a human lifetime is but a single tick of the cosmic clock. The journey can be disorienting; our first instincts are towards coziness, comfort, our mother’s enclosing arms, her breast. The journey, therefore, requires courage – for each individual, and for our species.

Uniquely of all animals, humans have the capacity to let our minds expand into the space and time of the galaxies. No other creatures can number the cells in their bodies, as we can, or count the stars. No other creatures can imagine the explosive birth of the observable universe 14 billion years ago from an infinitely hot, infinitely small seed of energy. That we choose to make this journey – from the all-sustaining womb into the vertiginous spaces and abyss of time – is the glory of our species, and perhaps our most frightening challenge.”

"Regret And Dread – Two Problems You Don’t Really Have To Have"

"Regret And Dread –

Two Problems You Don’t Really Have To Have"

by John Wilder

"I tend to like writing my Friday posts the most. Why? Most generally, I get away from the reality of the present situations that we are living in. That’s nice. Why do I feel like I can do this? Because nothing is done yet, and nothing is settled yet. I’ve written posts about regret. I still feel that regret is a wasted emotion – the past is done. Of course, I try to learn from my mistakes. But I can’t spend my life being upset about them. The real question is how can I incorporate the mistakes so I have a better future? I even told The Mrs. that she should embrace her mistakes, too. She was so happy she hugged me.

Especially of note are those mistakes I made that weren’t mistakes I made based on a lack of virtue. If I did the right thing, for the right reason, the result is the result, and I will live with the consequences. Sometimes bad things happen when you do everything right. I mean, when the doctor told me I had a rare disease, I asked, “How rare?” “Well, you get to pick a name.” Those are the breaks.

A similar emotion is dread. I read a quote when I was a kid – Heinlein? Twain? A fever dream while on laudanum writing about Xanadu? – that stuck with me. “Worrying about what might happen is paying interest on money you haven’t borrowed yet.” It’s a good quote. Regret is looking at the past, dread (or its cousin, fear) is about looking at the future. But they’re the same. Neither of those two things are real. One once was real, and one might be real.

I’ll admit that when I look out at the future, I do see dark days ahead. But right now, I’m sitting in my basement, The Mrs. had gone upstairs for sleep, the basement is perfectly comfy, and all is right with the world. Something might happen next week. Next month. Next year. The price of tires is up. The price of gasoline is up. Heck, Hunter Biden can’t even find decent meth nowadays. It will get worse.

So? I think that often we are more upset by the thought of potential future discomfort than actual, present discomfort. It can be consuming, and all for something that hasn’t happened yet. And, it used to be me. I used to do the math – how many months could I make mortgage payments if I lost my job? How many days could I feed my family? And, it’s one thing planning for that, but I was also sometimes scared.

Until one day I just decided to not be scared – I’d go through life and do my best, and let the chips fall where they may. I decided that it was fine to plan, it was fine to economize to save money, but it wasn’t fine to worry. So I stopped.

It was weird – one night I was worried, and the next night I decided that I wasn’t going to worry anymore. I just made the conscious decision I wasn’t going to worry anymore about that. It was the last significant worry that I gave up. I also worried about my short attention span, but that problem seems to solve itself. And it’s not like I live in a world where bad things don’t happen. I know bad things happen – horrible things. But today, I can choose not to worry about them.

Heck, I can pick something that is real and we can be certain that is going to happen – death. The shadow of death looms above us all. But to be consumed by it so that it causes a life lived in fear? That’s like already being dead. It might surprise some people, but death is something that isn’t new. Seneca, the (very dead) Roman stoic philosopher, said: “No man can have a peaceful life who thinks too much about lengthening it. Most men ebb and flow in wretchedness between the fear of death and the hardships of life; they are unwilling to live, and yet they do not know how to die.”

Reflect on death – if you knew that you wouldn’t wake up ever again, what would you do with your remaining hours? This reflection on death has multiple values to you and your character:

• It reinforces that which is important to us, here today.

• It exposes the frivolous that consume too much of our time.

• It shows what’s really of value – the money you made will be less important than the lives you’ve changed.

• You don’t have to worry about returning that library book.

Today is pretty good. Enjoy it. Skip the regret, the worry, and the dread. While you’re breathing, live. What can you make happen today?"

"Streets of Philadelphia, What’s Going On Today"

Full screen recommended.

kimgary, 4/16/22:

"Streets of Philadelphia, What’s Going On Today"

"Violent crime and drug abuse in Philadelphia as a whole is a major problem. The city’s violent crime rate is higher than the national average and other similarly sized metropolitan areas. Also alarming is Philadelphia’s drug overdose rate. The number of drug overdose deaths in the city increased by 50% from 2013 to 2015, with more than twice as many deaths from drug overdoses as deaths from homicides in 2015. A big part of Philadelphia’s problems stem from the crime rate and drug abuse in Kensington.

Because of the high number of drugs in Kensington, the neighborhood has a drug crime rate of 3.57, the third-highest rate by neighborhood in Philadelphia. Like a lot of the country, a big part of this issue is a result of the opioid epidemic. Opioid abuse has skyrocketed over the last two decades in the United States and Philadelphia is no exception. Along with having a high rate of drug overdose deaths, 80% percent of Philadelphia’s overdose deaths involved opioids2 and Kensington is a big contributor to this number. This Philly neighborhood is purportedly the largest open-air narcotics market for heroin on the East Coast with many neighboring residents flocking to the area for heroin and other opioids. With such a high number of drugs in Kensington, many state and local officials have zoned in on this area to try and tackle Philadelphia’s problem."

"You Can Never Tell..."

"You can never tell what people have inside them

until you start taking it away, one hope at a time."

- Gregory David Roberts

"We're Running Out of Time..."

Full screen recommended.

City Prepping, 4/16/22:

"We're Running Out of Time..."

Time is not on our side...things are moving quickly. What steps are you taking to prepare? In this video, we'll continue discussing practical steps you should be implementing. Download the FREE Prepper's Get Started Guide: https://www.cityprepping.com/getstarted/

"Which Lifeboat Will You Choose?"

"Which Lifeboat Will You Choose?"

by Charles Hugh Smith

"Consider a scenario in which we're on a ship that's sinking, and the lifeboats have been launched. Being some of the last still on board the doomed vessel, we can scan who's in each lifeboat and choose which one we'll clamber into. It's a consequential decision because the currents and weather are already separating the lifeboats, and so each lifeboat will be on its own. The seas are increasingly treacherous, and the nearby islands are surrounded by reefs which could shred the lifeboat's hulls in seconds.

While we don't know everyone on board, we've met many of the other passengers and crew and made the acquaintance of a fair number of our fellow castaways. So who do we choose to join? Our knowledge is imperfect: we only have first impressions and intuitions about the people who will potentially impact our life in a very direct and consequential way.

Do we choose to go in the lifeboat with a friend? This is certainly more appealing than a boat full of strangers. Do we choose a boat with an experienced sailor whose skills in the open ocean would improve our chances of surviving the ordeal ahead? Or do we choose a boat which is already under the control of a natural leader? If we understand that dithering and unresolvable conflicts can lead to disaster by default, then having someone in charge might be worth the risk that their leadership will lead to a catastrophically bad decision.

If we feel we have the experience to take charge and bring a lifeboat to safety, then perhaps we look for the disorganized, leaderless boat. Alternatively, we can weed out those boats we'll avoid as potentially dangerous because of the presence of domineering individuals with traits that have poor survival outcomes.

When The Little Prince hopscotches to various planets on his way to Earth, he encounters the King who desires a subject, a conceited man, a tippler (addict), a businessman who claims all the stars as his possessions and a lamplighter busy lighting and extinguishing the lamp every minute. These are parodies of human types, of course; The Little Prince found some modest favor in the lamplighter because he was the only one who was not self-obsessed/self-absorbed.

The boats I would avoid are those with wealthy, powerful people who confuse their position and wealth with competence, when actually there is no connection to competence beyond whatever specialized niche they used to acquire wealth and power. Their assumption (a form of privilege beneath the surface) that their specialized competence grants them universal competence is disastrously wrong-headed.

These are the types who will steer the lifeboat onto a reef despite the warnings of the less wealthy/powerful because their confidence in their judgment exceeds their grasp of risk/reality and their general life competence. They fail to understand the extreme narrowness of their experience and competence and have an overly high opinion of themselves due to their success in a narrow niche.

I would also avoid boats with individuals who triggered my BS detector, our intuitive animal assessment of the trustworthiness and self-absorption of individuals. For those who don't automatically filter out their negative assessments as "bad" and therefore "not allowed," this assessment is remarkably rapid and remarkably accurate.

Boats filled with self-important, self-absorbed people I would avoid as death traps. I would also avoid boats with do-gooders/would-be saints whose motivation (above self-preservation, until it's too late) is to defend the rights of the weak as the most important principle, even in life-and-death circumstances. These types are especially dangerous because their life experience is that Somebody Will Rescue Us. They thus conclude we can devote asymmetric resources to the weakest because Somebody Will Rescue Us.

They are incapable of recognizing the difference between making the vulnerable/dependent as comfortable as possible given the resources available and devoting the primary effort to saving everyone but if this can't be done, then saving as many people as possible. They are unable to recognize the need for difficult decisions that may well have asymmetric outcomes for the individuals on the boat. In demanding equal outcomes, they will lose everyone's lives -an outcome that is certainly equal but foolish.

Choosing a boat with an experienced open-ocean sailor is an obvious choice, as the sailor has experiential skills that apply specifically to the challenge at hand. But let's say that obvious choice means that boat is already filled to capacity.

So if the obvious best choice is not available, then what boat do we cast our lot with? I would look for a boat with low-key individuals with high situational awareness and experience in responding to crises and danger. Combat veterans come to mind, but there are many others with training and experience (or natural abilities) that aids their situational awareness, risk assessment and responses to rapidly evolving threats. The OODA loop (Observe, Orient, Decide, Act) is an example of this process.

I would also look for a boat with the increasingly rare individuals who do what they say they're going to do, and do it without self-obsessed drama/trauma or childish excuses. These individuals have a healthy awareness of their own limits and the limits of human nature. They don't overpromise to make themselves larger than they really are and they won't burden the rest of the boat with their self-absorbed histrionics or adolescent excuses.

Since I'm not qualified to lead as a sailor, and the only boat with an open-ocean sailor is full, I would look for a boat with a balance between hierarchy and self-expression/advocacy. The ideal situation is a boat in which every individual's advocacy of a particular action or strategy is carefully considered but the consensus reaches a decision and grants leadership to those with the best qualifications and most persuasive argument for their decision. Once the decision of a strategy has been made, then the boat unites behind pursuing this strategy.

It's instructive to consider the greatest open-ocean, open-boat voyages that have been recorded. Some had existing military hierarchies (for example, Captain Bligh's epic 4,000 mile voyage in a severely overloaded open launch) while others were castaways lacking a strict hierarchy. Whether the united effort of cooperation is imposed or agreed upon, this cooperation is key, as is a strategy based on the realities and risks.

Going it alone is a high-risk strategy. So is becoming dependent on self-important, self-absorbed people who are incapable of viewing reality as anything other than It's All About Me. I'm sure it's no surprise that the next five years will be risky and challenging; to the degree that we will be reliant on those closest to us, we are sharing a virtual lifeboat. Choose your boatmates carefully."

"Life's Funny..."

"Life's funny, chucklehead. You only get one and you don't want to throw it away. But you can't really live it at all unless you're willing to give it up for the things you love. If you're not at least willing to die for something - something that really matters - in the end you die for nothing."

- Andrew Klavan

"16 Harsh Truths That Make Us Stronger "

"16 Harsh Truths That Make Us Stronger

"

by Marc Chernoff

"1. Life is not easy. Hard work makes people lucky, it's the stuff that brings dreams to reality. So start every morning ready to run farther than you did yesterday and fight harder than you ever have before.

2. You will fail sometimes. The faster you accept this, the faster you can get on with being brilliant. You'll never be 100% sure it will work, but you can always be 100% sure doing nothing won't work. So get out there and do something! Either you succeed or you learn a vital lesson. Win, Win.

3. Right now, there's a lot you don't know. The day you stop learning is the day you stop living. Embrace new information, think about it and use it to advance yourself.

4. There may not be a tomorrow. Not for everyone. Right now, someone on Earth is planning something for tomorrow without realizing they're going to die today. This is sad but true. So spend your time wisely today and pause long enough to appreciate it.

5. There's a lot you can't control. Wasting your time, talent and emotional energy on things that are beyond your control is a recipe for frustration, misery and stagnation. Invest your energy in the things you can control.

6. Information is not true knowledge. Knowledge comes from experience. You can discuss a task a hundred times, but these discussions will only give you a philosophical understanding. You must experience a task firsthand to truly know it.

7. You can't be successful without providing value. Don't waste your time trying to be successful, spend your time creating value. When you're valuable to the world around you, you will be successful.

8. Someone else will always have more than you. Whether it's money, friends or magic beans that you're collecting, there will always be someone who has more than you. But remember, it's not how many you have, it's how passionate you are about collecting them. It's all about the journey.

9. You can't change the past. As Maria Robinson once said, "Nobody can go back and start a new beginning, but anyone can start today and make a new ending.

" You can't change what happened, but you can change how you react to it.

10. The only person who can make you happy is you. The root of your happiness comes from your relationship with yourself. Sure external entities can have fleeting effects on your mood, but in the long run nothing matters more than how you feel about who you are on the inside.

11. There will always be people who don't like you. You can't be everything to everyone. No matter what you do, there will always be someone who thinks differently. So concentrate on doing what you know in your heart is right. What others think and say about you isn't all that important. What is important is how you feel about yourself.

12. You won't always get what you want. As Mick Jagger once said, "You can't always get what you want, but if you try sometimes you might find you get what you need.

" Look around. Appreciate the things you have right now. Many people aren't so lucky.

13. In life, you get what you put in. If you want love, give love. If you want friends, be friendly. If you want money, provide value. It really is this simple.

14. Good friends will come and go. Most of your high school friends won't be a part of your college life. Most of your college friends won't be a part of your 20-something professional life. Most of your 20-something friends won't be there when your spouse and you bring your second child into the world. But some friends will stick. And it's these friends, the ones who transcend time with you, who matter.

15. Doing the same exact thing every day hinders self growth. If you keep doing what you're doing, you'll keep getting what you're getting. Growth happens when you change things, when you try new things, when you stretch beyond your comfort zone.

16. You will never feel 100% ready for something new. Nobody ever feels 100% ready when an opportunity arises. Because most great opportunities in life force us to grow beyond our comfort zones, which means you won't feel totally comfortable or ready for it.

And remember, trying to be someone else is a waste of the person you are. Strength comes from being comfortable in your own skin.

"

"At This Point I Reveal Myself..."

"At this point I reveal myself in my true colors, as a stick-in-the-mud. I hold a number of beliefs that have been repudiated by the liveliest intellects of our time. I believe order is better than chaos, creation better than destruction. I prefer gentleness to violence, forgiveness to vendetta. On the whole I think that knowledge is preferable to ignorance, and I am sure that human sympathy is more valuable than ideology. I believe that in spite of the recent triumphs of science, men haven't changed much in the last two thousand years; and in consequence we must try to learn from history. History is ourselves.

I believe in courtesy, the ritual by which we avoid hurting other people's feelings, by satisfying our own egos. And I think we should remember that we are all part of a great whole, which for convenience we call nature. All living things are our brothers and sisters."

- Kenneth Clark, "Civilization"

"History Repeats Itself- Unfortunately"

"History Repeats Itself- Unfortunately"

by Michael Reagan

"Forty years ago we had a soaring inflation rate, obscene gas prices and interest rates in the teens. Today, thanks to their incredible incompetence, bad policies and serial stupidity, the Democrats in Washington are bringing back all those problems.

It’s getting so bad, I’m actually beginning to think Jimmy Carter was not such a bad president after all. People under 40 have no idea how bad things were in the late 1970s under Carter. They’ve grown up knowing only 3 percent interest rates, dirt cheap gasoline and 2 percent inflation. They don’t know how miserable things were under Carter or how miserable they can get again under Biden.

My friend who owns a local tire store in Los Angeles doesn’t need a history book to remember how awful America was in the early 1980s because he lived through it. When I got an oil change at his place this week, he was railing about how today's official inflation rate of 8.5% doesn't come close to the real figure. “Where is the thing I’m buying that’s only gone up eight and a half?” he asked. “The tires I’m buying aren’t only up eight and a half percent. The gas and food I’m buying are not only up eight and half.”

He’s right, and you don’t have to be Sen. Joe Manchin of West Virginia to know it. Earlier this week, when the new monthly inflation figures came out, Manchin, arguably the last sensible Democrat with an elected job in Washington, rattled off some of the real numbers. Year over year, gasoline is up 48%. Beef is up 16%, chicken and milk up 13% and coffee and eggs up 11%. Used car prices are up nearly 40% - and the wait to get a new one feels almost as long as it was in 1981 Moscow.

Democrats have created our economic and social problems themselves - in just 14 months - but they always try to blame them on bad or greedy other people. They say that if the rich would just pay more in taxes – their so-called “fair share” - ordinary people will somehow be better off, as if the additional taxes the rich are forced to pay will go directly to needy people. But the reality is, as the last 75 years have proven again and again, Democrat policies always hurt the poor and middle class the hardest, not the rich.

For example, I have a Ford F-150 pickup and with gas in California going for almost $6 a gallon it costs me nearly $200 for a fill up. I can afford that, but my daughter-the-school-teacher can’t. Neither can my son, who has two young girls. Neither can the grocery clerk or the waiter at a restaurant – but the owners of the grocery store chain or the restaurant can.

The last good Democrat president was Bill Clinton. He balanced the budget, gave us welfare reform and actually worked well with Republicans, but we'll never see his like again. Today we’re watching the usual Democrat horror story playing out with the added bonus of a president who does everything backwards.

President Biden, following the Democrat playbook, blames Vladimir Putin, the rich and gouging oil company CEOs for high gas prices - anyone but his administration, which caused them by shutting down pipelines and generally abusing America's productive energy sector.

Given the way the Democrats are governing in D.C. now, things will never change for the better unless a miracle happens. That’s what happened in 1980 when Ronald Reagan came to Washington and turned things around by lowering taxes, cutting government regulations and lifting the country’s spirits. To many of us old-timers it feels like the early 1980s all over again. And the only way the country will ever recover from the damage of the Biden Gang is to elect a Republican worthy of being president. Thank God there will be many candidates."

"The Definition Of Stupid..."

"The wise try to adjust themselves to the truth,

while fools try to adjust the truth to themselves."

- Thibaut

"The Economy is Slowing Down and the Dam is About to Break"

Full screen recommended.

Dan, iAllegedly 4/16/22:

"The Economy is Slowing Down and the Dam is About to Break"

"The Global Economy is slowing. People need to prepare before the dam breaks. Now there are more bank warnings about liquidity and some stores are even limiting purchases."

"This Cheeseburger Explains Your Bigger Grocery Bill"

"This Cheeseburger Explains Your Bigger Grocery Bill"

By Ximena Bustillo and Steven Overly

"American consumers are seeing food prices rise at the fastest rate in decades. Supply chain snarls, labor shortages and climate challenges (plus the conflict in Ukraine) share the blame. To understand what’s driving the nation’s largest increase in food prices in 40 years, just take a close look at your all-American cheeseburger.

Whether it’s a humble bun and patty, or piled high with fixings, the rising cost of each ingredient is the product of a range of economic forces and geopolitical conditions that are disrupting how our food gets from the farm to our tables. They include interrupted supply chains, dire labor shortages, climate disasters and, most recently, the war in Ukraine.

The March Consumer Price Index report showed that the prices for food both consumed at home and away from the home (i.e. at restaurants) saw the largest 12-month increases since 1981. Those rising prices are inflicting pain across the board: from farmers paying higher production costs; to families buying groceries; to the Biden administration, which has seen its popularity sink as inflation hits historic highs.

The cost of food has always been politically fraught. It is influenced by a range of factors that have long sparked debate, from land use and environmental regulations, to labor rights and immigration policy. But the current price hike has thrust the issue into the political spotlight, prompting policymakers to pursue policies intended to un-jam shipping routes, increase market competition and mitigate climate change.

The BUN +7.1%: The increased cost of a burger starts with the all-essential bun. The price of bread went up 7.1 percent in March compared to a year prior, while the price of all bakery products climbed 9.1 percent. What's behind the price increase? U.S. port congestion has hampered a broad swath of American businesses over the past two years and the nation’s bread bakers are no exception.

The U.S. imports most of its gluten from overseas nowadays, along with product packaging and specialty ingredients, said Robb MacKie, the president and CEO of the American Bakers Association. The port backlog meant bakers were waiting longer for those products, assuming they could get them at all. MacKie said about 50 input costs that bakers track had jumped by double digits as of January, including hikes in the prices for wheat and the natural gas needed to power ovens. And that was before Russia invaded Ukraine, a major wheat exporter.

What to watch for next: Russia’s assault on neighboring Ukraine has effectively taken one of the world’s top wheat producers off the market. That alone has global ramifications, but it’s compounded by a recent ban on Russian oil and gas that is exacerbating already-high energy prices. “On the global market, we're just seeing phenomenal [price] increases already,” MacKie said. And he warned that “if Ukraine is not able to get … their spring crops into the ground, we could see some very significant food security issues around the world.”

The BACON +18.2%: Meat eaters may be inclined to top their burger with strips of bacon, at a cost. The price of bacon has jumped 18.2 percent from March 2021 to March 2022. What's behind the price increase?

About 16 percent of the domestic pork supply goes into producing bacon, with Iowa, Minnesota and North Carolina leading the nation in pig production. Four companies - Smithfield, JBS, Tyson and Hormel - control 67 percent of the market, raising concerns from the Biden administration, which has made the industry a focus of its anti-consolidation push.

Meatpackers, however, argue that the Biden administration is using them as a scapegoat and ignoring other causes of inflation. The National Pork Producers Council, for example, blames increased transportation costs, supply bottlenecks and delays and increased labor costs throughout the pork chain as bigger culprits of rising prices.

What to watch for next: Pork producers have been warning of the impacts of decreasing farm labor accessibility and are calling for unlimited access to H-2A visas for temporary agricultural workers. But divides between Senate and House Republicans have stalled negotiations on changes to the visa program.

Other potential challenges could include California’s Prop 12 law, which places animal housing requirements on all pork producers who sell their products in the state, regardless of where they are based. Pork industry advocates say it could increase the price of pork if fully enacted. The Supreme Court has accepted a lawsuit next term challenging Prop 12, setting up a court battle for later this year.

The EGG +11.2%: Debate the chicken-or-egg origin story all you want; both cost more money nowadays. The price of eggs was up 11.2 percent in March compared to a year prior.

What's behind the price increase? The humble egg experienced a pandemic-induced boon in 2020, as more Americans cooked their meals at home. Marc Dresner, a spokesperson for the American Egg Board, explains that egg sales shot up dramatically when lockdowns started, and remained up 8.5 percent for the rest of that year. The latest data show that sales have since slowed, but were still up 3.9 percent in January compared to the year before. That means demand has remained above the industry’s pre-pandemic growth rate of 2 percent per year.

The persistently high demand is one factor behind the rise in egg prices. Farmers have also had to pay more money for chicken feed and for transportation. Many have also struggled, like other agriculture employers, with employee retention. That all adds to their operation costs.

What to watch for next: Consumer demand for eggs is expected to return to pre-pandemic levels as old shopping and dining habits gradually return. That could ease some of the upward price pressure. But the other factors driving up farmers’ costs remain hard to predict. Labor shortages and logistical challenges, such as the dearth of truck drivers and the soaring price of gasoline, will likely keep egg prices elevated along with other consumer goods.

The Avocado +39%: Avocados don’t just go on toast. The average avocado price is $1.39, which is 39 percent higher than it was the same time last year, according to data from the Hass Avocado Board.

What's behind the price increase? Over 80 percent of avocados sold and distributed for consumption in the U.S. are imported from Mexico, with some states such as California, Florida and Hawaii growing them as well. That means disruptions to the supply chain that transports the fruits from Mexico to states across the country can put upward pressure on prices.

Just one example: Regular avocado eaters may recall that at the start of the year, USDA paused inspections of Mexican avocados after a U.S. inspector in Mexico received a threatening phone call from a cartel member after denying a shipment of avocados. Organized crime groups in Mexico, and specifically Michoacan, where most of the U.S. avocados are produced, have gotten involved in the production and marketing of ag products. The halt meant any uninspected fruit could not be imported, creating concerns about a sudden shortage. This was not the first time the U.S.’s avocado supply was affected by security concerns. USDA employees previously received threatening messages in 2019.

What to watch for next: American demand for avocados has soared in recent decades, which has also contributed to higher prices. And over that time, the U.S. has become increasingly reliant on Mexico to satiate its appetite for guacamole and avocado toast. Some American growers warn that dependence means domestic producers, who already struggle to compete on price, would not be able to keep up with demand in the event of disruptions abroad. Those disruptions would thus force U.S. distributors to find avocados from new sources, a process that consumes both time and money.

Meanwhile, Mexico is looking to expand its avocado dominance in the U.S. market. It has been asking the U.S. government for greater access to the American market, but agriculture negotiators have conditioned that on Mexico granting full market access to U.S. fresh potatoes. U.S. exports of fresh potatoes to Mexico have been limited to only the first 16 miles past the border for the last two decades. But last year, the Mexican Supreme Court ruled that blocking increased market access was illegal, a victory for U.S. producers who had challenged the limits. Agriculture Secretary Tom Vilsack announced earlier this month that opportunities to expand U.S. potato exports could begin as soon as May.

The Tomatoes +1.7%: The tomato has seen a relatively modest increase compared to our other burger ingredients. The price ticked up 1.7 percent between March 2021 to March 2022.

What's behind the price increase? Labor and inflation are the main drivers of the price increase. The costs of production, including diesel fuel for machinery and wages for farmworkers, have gone up, and the industry has become increasingly reliant on H-2A visas to bring in foreign farmworkers, which is a more expensive labor force.

Most of the tomatoes produced in the United States for domestic consumption come from California and Florida, which produce 25 percent and 40 percent, respectively. And a majority of those tomatoes go to the food service sector, where they are eventually used on items such as hamburgers. “We can either import our food or we can import workers because it's getting very difficult to farm in the United States with the scarcity of labor,” said Michael Schadler, executive vice president of the Florida Tomato Exchange. “So if we want to keep producing food in this country, there's got to be a way to access that workforce.”

What to watch for next: Production costs along the tomato supply chain are up about 30 percent in Florida and eyes are on the continued rise in fuel prices caused by the conflict in Ukraine. But you can’t blame tomatoes for the increased cost of your burger: Many producers have been unable to increase the prices of their products due to the need to compete with imports from places such as Mexico.

Food industries that have competition from imports have difficulty passing increased production costs to consumers because their products are then less competitive against cheaper imports, according to Schadler, especially given that the price of labor in the U.S. is increasing faster than it is in Mexico. “As far as inflation of the tomato on a burger, you really aren’t seeing much because the market is very tough and market prices are significantly below our cost of production. It's been a tough season,” he said.

Members of Congress from states including Georgia and Florida have long been calling for the U.S. to investigate how Mexican imports of items like tomatoes have resulted in an unfair advantage against domestic producers.

The LETTUCE +12%: Leafy greens come at a price, too. The cost of lettuce increased 12 percent in March compared to the prior year.

What's behind the price increase? Most lettuce consumed in the U.S. is grown in either California or Arizona. Those greens have to then be shipped throughout the country, which is a more expensive undertaking when trucking capacity is constrained and gasoline prices are soaring. But lettuce growers are uniquely stressed due to climate and weather-related challenges, from unseasonal temperatures to drought, which have disrupted traditional growing patterns.

“Right now, lettuce growers in the U.S. have been hit by the perfect storm of weather challenges that have caused the spike in prices that consumers are seeing in stores,” said Joe Watson, the vice president of retail, foodservice and wholesale, at the International Fresh Produce Association. “Ice, cold temperatures and wind in California and Arizona desert growing areas have reduced the quality and overall amount of lettuce coming out of these regions,” Watson continued.

What to watch for next: Lettuce production shifted northward in April with the season change, and the new location is expected to yield more bountiful harvests, Watson said. But supply chain and labor issues will persist, and climate challenges will continue to confront farmers.

The MAYO +14.9%: As far as condiments are concerned, mayonnaise is both high in calories and, now, higher in cost. In March, the price of fats and oils was up 14.9 percent compared to last year.

What's behind the price increase? Soybean oil is a key ingredient in many processed foods, including mayonnaise and salad dressing, notes Jeannie Milewski, executive director of the Association of Dressings and Sauces. Competition for soybean oil has been stiff, as it’s also vital to advanced biodiesel, a vegetable-oil based fuel that powers diesel engines. That means food purveyors and renewable energy producers are vying for the same commodity, driving up its market price.

What to watch for next: Advocacy groups like ADS have warned that demand for soybean oil will grow - and consumer prices will keep rising - due to new energy regulations proposed in December by the Environmental Protection Agency, which wants to increase the volume of advanced biodiesel for use as a low-carbon fuel. That could help the administration achieve its climate goals, as biodiesel has a lower environmental footprint than fossil fuels, but increased demand without a comparable expansion in production would push prices higher, industry groups warn.

The CHEESE +3.1%: There is no cheeseburger without the cheese - American, cheddar, perhaps a spicy pepper jack. The price of cheese climbed 3.1 percent from March 2021 to March 2022.

What's behind the price increase? American cheese is almost exclusively produced in… America. Wisconsin, California and Idaho lead the nation in cheese production - logistically, it is easier to produce and distribute cheese products regionally to reduce the amount of time milk, the perishable key ingredient, is in transit. Increased freight distances would mean more emissions and more travel costs.

As with many animal products, labor availability is one of the major barriers to smooth production processes. From the farm to processing facilities to truck drivers who distribute the product, labor shortages in agriculture have been a problem across the board for decades but were supercharged during the pandemic and recovery, as workers got sick, causing shutdowns.

Water supply is also an issue as drought continues to plague the West, and affects the type of crops and how much farmers can grow. Some of those crops are eventually made into cow feed. “As you look at drought and the lack of precipitation for us, it's definitely going to have an impact on feed costs,” said Rick Naerebout, CEO of the Idaho Dairymen’s Association. “At the end of the day, you still have to be able to feed these cows.”

What to watch for next: The limited availability of work visas continues to be an issue for many employers - over 50 percent of agriculture and 90 percent of dairy workers are estimated to be foreign born or undocumented. At the same time, a decreasing rural population and increased reliance on foreign labor has put the agriculture industry at the center of immigration debates. “It just seems baffling that our politicians can't figure out that we don't have the domestic workforce to fill the jobs we need filled and businesses are being stifled and inflation is being increased because we can't find enough workers,” Naerebout said.

Local governments nationwide are also on standby waiting for the federal government to unroll more infrastructure funding dedicated to building and improving western water infrastructure. In 2021, many ranchers found themselves needing to transport their cattle and feed from other states because of dry conditions. Others had to cull parts of their herds.

The BEEF +16%: Beef may be last on our list, but it’s arguably the most crucial element of any authentic burger. It now costs 16 percent more compared to March 2021.

What's behind the price increase? The Biden administration has taken a targeted swing against the top four big meatpackers - Tyson, JBS, National and Cargill - accusing them of increasing prices on meat products while keeping rancher profits low. The four companies control over 80 percent of the beef supply chain. That consolidation raised concerns during the pandemic, when hundreds of thousands of workers around the nation got sick with Covid-19, forcing processing plants to close. The shutdowns resulted in empty butcher counters at supermarkets and left ranchers with nowhere to take their animals that were ready to process.

As with bacon, beef processors and industry advocates argue that consolidation isn’t to blame, turning the focus to supply chain disruptions, operating capacity levels and drought.

What to watch for next: Now, the Biden administration is trying to prop up local and regional meat supply chains in hopes of creating more competition for the Big Four meatpackers and giving ranchers a local alternative. Republican lawmakers on the Hill are in a standoff over how to best manage and promote competition in the industry, however.

Labor and climate change also continue to pose risks. Many large meat processing plants rely on H-2B visas for foreign farm workers - 70 percent of animal slaughtering and processing labor is estimated to be foreign born or undocumented. Since the pandemic, many processing plants have struggled to reach full capacity processing levels. On the climate side, continued drought in 2021 resulted in lower yields of crops used for cow feed, and limited water availability across the West. The lower feed availability created a domino effect of higher prices."

○

Related:

○

"The Dam Is Finally Cracking"

"The Dam Is Finally Cracking"

by Charles Hugh Smith

"We all sense the global order has cracked. The existing order is breaking down on multiple fronts. Those who have benefited from this arrangement are doing everything in their power to patch the cracks, while those who chafed under the old order's chains seek a new order that suits their interests.

The task now is to make sense of this complex inflection point in history. Two statements summarize the transition from the existing global order to the next iteration:

1. Finance dominated resources in the old order. Now the roles will reverse and real-world resources will dominate finance. We can't "print our way" out of scarcities.

2. Reshuffling currencies and credit will not stop the breakdown of the global order's "waste is growth" Landfill Economy Model.

Playing financial tricks has extended the life of an unsustainable economic model that glorified "growth" from wasting resources. By expanding credit "money," the current global order fueled unsustainable consumption driven by unsustainable speculation. Stop expanding "money" and credit and the global order of "growth" implodes.

The Dam Is Finally Cracking: Unfortunately for all those who benefited from soaring wealth and income inequality, the trick of expanding "money" and credit has reached systemic limits. The dam holding all the toxic debt, leverage and fraud is finally cracking. The dominance of resources over finance leads to a multipolar global order, an order that has the potential to be far more stable and sustainable than the unsustainable, destabilizing "waste is growth" model that depends on financial fraud to maintain the illusion of "growth."

As I explain in my book "Global Crisis, National Renewal," scarcity leads to either social disorder or rationing. This article explains how government's role will shift from boosting demand (the Keynesian Cargo Cult) to limiting demand in ways that maintain the social contract.

Nations that fail to adapt to the end of financialization and globalization will unravel. Every nation has a choice which path it takes: Cling on to the doomed existing order of financialization, globalization and the "waste is growth" Landfill Economy or embrace a multipolar world and a degrowth model of doing more with less and incentivizing efficiency and durability rather than the shoddy planned obsolescence of the debt-dependent Landfill Economy.

Free Money Is the Solution: Under various guises, labels and rationalizations, "free money" has now been established as the default policy fix for any problem. Stock market falters? The solution: free money! Economy falters? The solution: free money! Bankers face collapse from ruinously risky bets? The solution: free money! Infrastructure crumbling?

The solution: free money! Inflation raging? The solution: free money! Ruh-roh. We have a problem free money won't fix. Instead, free money accelerates the conflagration. Dang, this is inconvenient; the solution to every problem makes this problem worse. Now what do we do?

Despite the apparent surprise of the policy-makers, pundits and apologists, this was common sense. Create trillions of dollars out of thin air and spread the money around indiscriminately (fraudsters and scammers getting more than the honest, of course) after global supply chains were disrupted and shelves were bare, then open the floodgates of speculative gambling in stocks, cryptos, housing, used cars, bat guano, quatloos, etc., and what do you think will happen?

Supply can't catch up with free-money-boosted demand, prices rise, people instinctively over-order and over-buy, and "don't fight the Fed" speculative betting begets more betting: the inflation rocket booster ignites, wages soar as workers try to keep pace with rising expenses, speculative bubbles inflate to unprecedented extremes, and all this "wealth without work or productivity" gooses spending and gross domestic product (GDP).

“Once the Bubbles Pop, GDP Crashes and the Ratio Blows Out”: Forty years ago, the total debt-to-GDP ratio was 1.6: debt was $4.8 trillion and GDP was $3 trillion. Then the policy solutions of fiscal "borrow and spend" and Federal Reserve "balance sheet expansion." a.k.a. free money, became the policy default.

The ratio rose to 2.76 in 2000 and has wobbled around 3.7 for the past decade, a decade that just so happened to see the stock market quadruple and the housing bubble reinflate to new heights as the Federal Reserve kept interest rates near zero as part of the "free money" policy: If we're going to borrow tens of trillions of dollars to squander, we need near-zero interest rates to keep costs of borrowing down.

Though no one in a position of power or influence dares admit it, the ratio of debt to GDP hasn't blown out for one reason: speculative bubbles have pushed GDP higher in a massive, sustained distortion of "wealth effect" and winner take most gains for those who knew how to extract the majority of gains from the bubbles.

Once the bubbles pop, GDP crashes and the ratio blows out. The belief that adding trillions in debt magically adds GDP will be revealed as delusional fantasy.

Two Paths: Completely forgotten in the era of Free money as the solution to all problems is the discipline of frugality, which can best be defined as discipline over spending as a means of building long-term financial stability and general well-being. Financial discipline (frugality) has been set aside as a needless discomfort: why make difficult tradeoffs and sacrifices when the solution is just to borrow/create more free money? Indeed. Along the same lines, why bother with all the hassles of healthy food and fitness? Just pig out and swallow a couple handfuls of "free" (heh) meds.

Discipline isn't just about limiting waste. It's about investing capital and labor wisely to secure future gains in productivity which is the only real source of income and wealth. Creating "money" out of thin air and spreading it around to satisfy every constituency doesn't increase productivity. It destroys productivity by incentivizing waste – the waste is growth Landfill Economy – and speculative bets on bubbles never popping. Alas, all bubbles pop, and now that creating free money only makes costs rise faster, there is no solution other than – oh, dear, dear, dear – the unforgiving discipline of frugality and investing for productivity gains rather than for speculative bubble "wealth."

Which path leads to doom? Free money. Which path leads to revival? Frugality and discipline. That's not what everyone wants to hear, but clinging to delusional fantasies of "free wealth" won't lead to positive outcomes, any more than swallowing handfuls of meds leads to "free health."

Friday, April 15, 2022

"25 Facts About The Explosive Growth Of Poverty In America That Will Blow Your Mind"

Full screen recommended.

"25 Facts About The Explosive Growth Of

Poverty In America That Will Blow Your Mind"

by Epic Economist

"The rest of the world sees America as the wealthiest nation on the entire planet. But when we take a closer look at the hardships our population is facing, we can rapidly realize that there's a tremendous amount of financial suffering in the United States, and that's getting dramatically worse with each passing year. Today, more money goes towards the pockets of the rich than ever before. Over the past few decades, we've been witnessing the greatest event of wealth transfer in the history of our nation without even realizing it. While billionaire CEOs like Mark Zuckenberg make over a million times more than the average American worker every year, many families out there, whose parents work themselves to the bone every single day, will still struggle to find what to eat and where to sleep with their children tonight.

Extreme poverty continues to grow all across the country. According to an analysis released by the University of Chicago, at least 336,000 households with children live on less than two dollars a day. That’s a group known as the ultra-poor. Amid skyrocketing housing and rent prices, at least 600,000 Americans remain in a group known as the “unhoused”. “Right now, we are still trending in the wrong direction,” explained Anthony Love, interim executive director at the United States Interagency Council on Homelessness. “When the public is told that one particular policy is going to end homelessness, what they’re expecting is that they’re going to see fewer homeless people around,” added Stephen Eide, a senior fellow at the Manhattan Institute. What they haven’t considered yet is that housing has to come first, Eide stressed.

Meanwhile, the gap between the rich and the rest of the population is worsening. On average, the top 1% of earners make 20 times more than the bottom 90% every year. The wealth disparity grows the higher up the ladder we climb. Even the mid-level one-percenters can’t reach the gigantic amounts earned by the ultra-rich. These disparities make us question whether the US is indeed a rich nation or a nation for the rich. The answer is up to interpretation, but you can have a clearer picture about this issue at the end of this video. Today, we gathered some staggering stats that expose that poverty in the United States is wildly out of control. Here are 25 Facts About The Explosive Growth Of Poverty In America That Will Blow Your Mind. "

"This Is Getting Serious"

"This Is Getting Serious"

by Jeffrey Tucker

"Today is Tax Day, April 15. But in reality, every day is tax day. Government is constantly trying to rob us through the inflationary tax, which is a hidden tax. Yet some inflationary indices are more telling than others. Let’s break it down…

The Producer Price Index is a far more important number than the Consumer Price Index because it shows what’s coming in the future. What hits producers now later hits consumers. And here, at last, even the official numbers have crossed into the dreaded category of double digits. Year over year, March to March, the PPI shows a 11.2% increase, the largest on record, and that likely means in 250 years in the US.

Calculating the latest increases against one year ago actually understates the CPI (the three-month change is actually 25%). But with the PPI, matters are different. Producer prices started their dramatic rise one year ago, so this 12-month increase is pretty accurate. Except for one thing: it keeps getting worse month after month. March was the worst ever. So unless there is a dramatic push in the opposite direction (hahahaha) the PPI likely headed to 15% and then 20%.

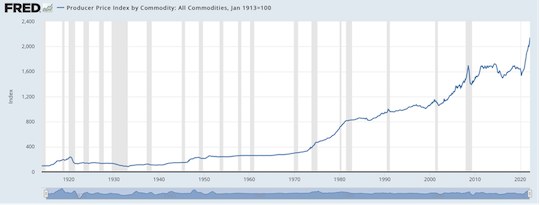

A Grim Picture: Let’s look at this visually, choosing 1913 (the date of the Fed’s founding) as the baseline 100.

It’s a grim picture of the reality of what’s happened to us. In a remarkably short period of time.

Let’s take another look starting with 2010, expressed as a percent change from one year ago.

This Is Getting Serious: This is no longer about just prices. It’s about economic health and social stability. These kinds of increases are capable of wiping out a million small businesses, under even the slightest recessionary conditions. It wasn’t enough that hundreds of thousands were destroyed during lockdowns. The inflation of our times is a mortal threat to the rest.

What’s more, absolutely no one has a viable strategy on how to deal with it. The Biden administration’s attempt to blame Putin is transparently ridiculous, and so are its solutions of browbeating business and shoving more corn into our gas tanks. The only real solution is for the Fed to enact dramatic increases in the federal funds rate, thus stopping the machinery of inflation, or at least that would be the hope. It might not work but it would certainly plunge the US economy into a deep recession. To watch all the experts out there flailing around right now is truly painful. I’ve yet to read a public article that tells the truth about the problems and the solutions.

How Bad Can It Get? Do you remember how the New York Times was first out with its demand that we “go medieval” on Covid? That was more than two years ago. Now they see the carnage they inspired, and its become even too much for them to watch the horrors of Shanghai today. A writer on the op-ed page presents this picture: "Wang Lixiong, the author of the apocalyptic novel “China Tidal Wave,” which ended with a great famine in the aftermath of a nuclear winter, believes that a man-made crisis like the one in Shanghai is inevitable under China’s authoritarian system. In recent years, he said in an interview, the risk increased after Beijing clamped down on nearly every aspect of civil society.

After moving into a friend’s vacant apartment in Shanghai last winter, he stocked up on rice, noodles, canned food and whiskey to sustain him for a few months in case of a crisis. But many residents in the luxury apartment complex, with units valued at more than $3 million, weren’t as prepared when the lockdown started. He saw his neighbors, who dashed around in designer suits a month ago, venture into the complex’s lush garden to dig up bamboo shoots for a meal.

The worst nightmare for many Shanghai residents is testing positive and being sent to centralized quarantine facilities. The conditions of some facilities are so appalling that they’re called “refugee camps” and “concentration camps” on social media.

Many people shared packing lists “ and tips for quarantine. Take earplugs and eye masks because it’s usually a giant place like the convention center and the lights are on day and night; pack lots of disposable underwear because there’s no shower facility; and bring large amounts of toilet paper. Some quarantine camps were so poorly prepared that people had to fight for food, water and bedding."

Coca-Cola Is Hard Currency: And here’s the sentence that truly made my blood run cold, and yet I know it is true: “The policy still enjoys strong public support. Many people on social media said that Shanghai wasn’t strict enough in its lockdowns and quarantines.” The author notes in passing that “Neighbors resorted to a barter system to exchange, say, a cabbage for a bottle of soy sauce. Coca-Cola is hard currency.”

What’s going on here? People are preferring the immediacy of food and other goods over what was previously used as money. That’s civilization itself devolving to the most primitive level, as in jail. Which makes sense: one of the world’s most wonderful and prosperous cities has been turned into a giant prison for 26M people.

As a result, Coke has become a form of money, which is to say a good that one acquires, not to consume, but rather to trade for something else. Clearly the writer does not understand the implications of this. The only time when such a thing happens is when there are no other options. When you have to price your bamboo shoots in terms of bottles of coke, there is a major problem.

The Essence of Barter: I really don’t want to become apocalyptic here but there is a point to learning barter skills now in case we should ever get to this point, either in our communities or the country or the globe.

When I was in college and paying my own way, I discovered a little secret of getting by. I had a skill. I could bake bread. It did this all Sunday afternoon, the only day I had. I would make a dozen loaves. Then throughout the week, I would distribute them to my dry cleaner, my tailor, the guy who fixed my car, the grocer across the street, the doctor, the dentist, or anyone with whom I did business. I would just take it in and present it and leave.

What I found was that my gifts netted huge returns. Free dry cleaning. Car checkups at no cost. I was first in line at the doctor. The grocer gave me free stuff constantly. The more I gave, the more I got. This is a form of barter. It worked. I spent pennies on ingredients and made back the difference a thousand fold in goods and services returned.

I will conclude with a practical suggestion. Figure out something you can do and do it for others in your immediate community. Sow good will. Become a benefactor to merchants. They will be there for you in a crisis. As we see in Shanghai, this can be a matter of life and death."